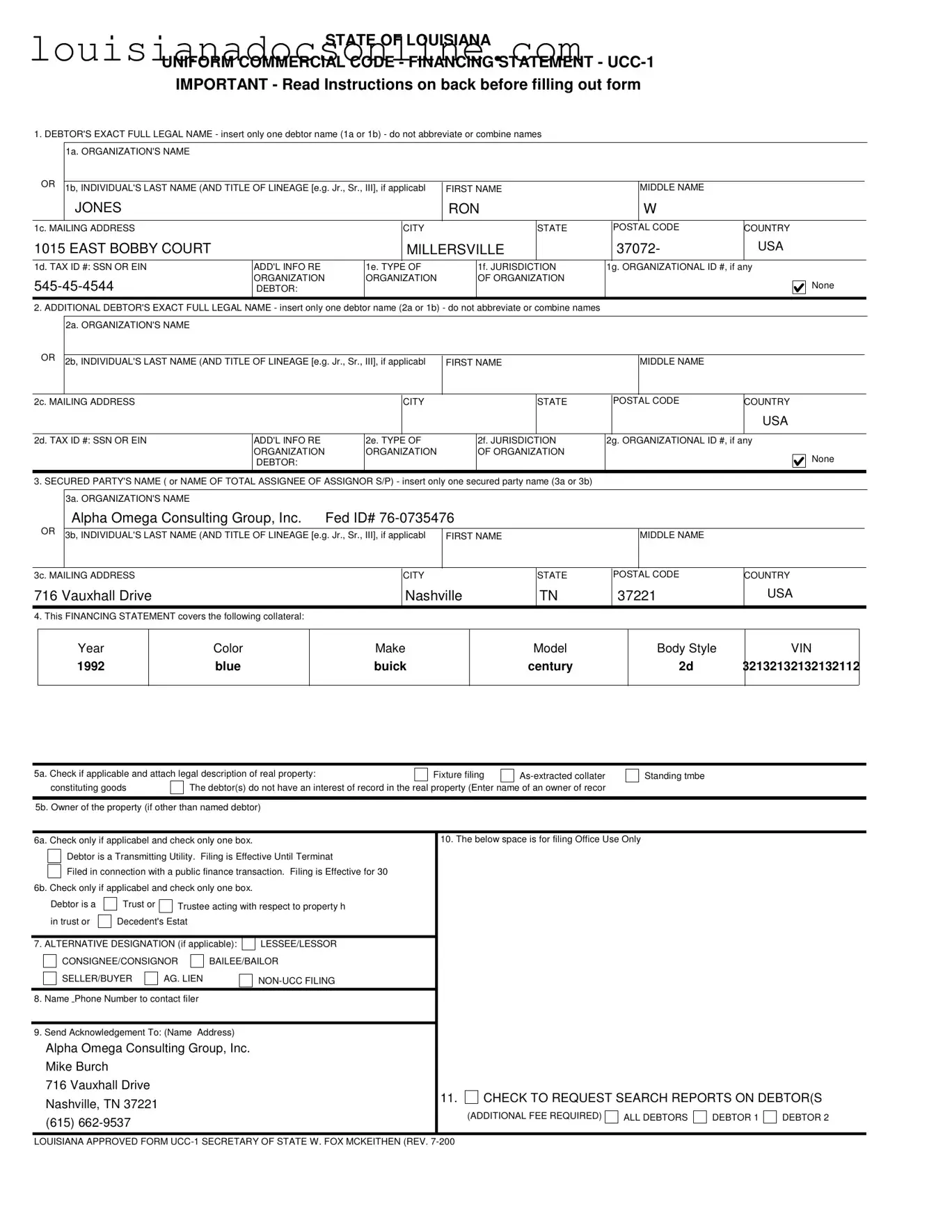

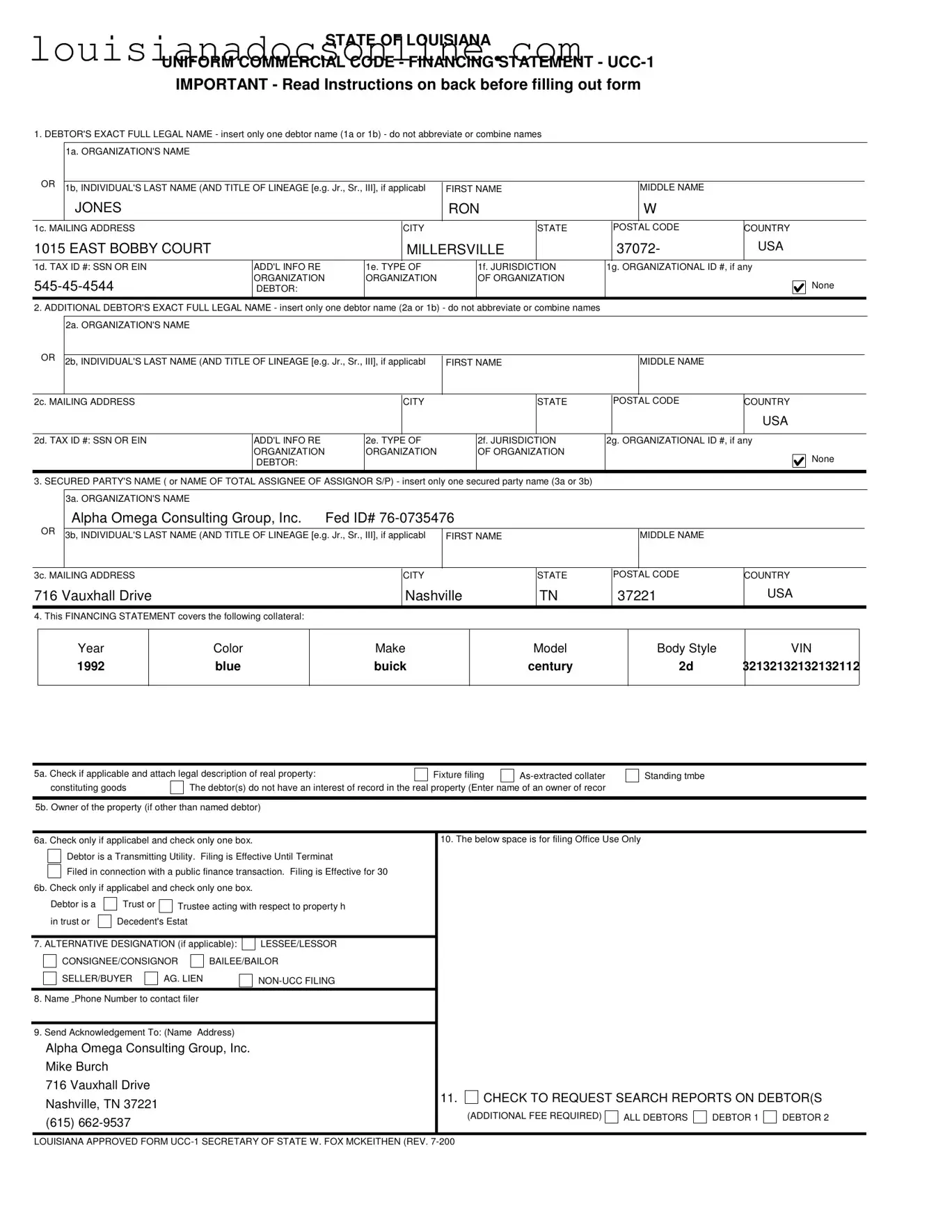

Ucc 1 Louisiana Form

The UCC-1 Louisiana form is a legal document used to secure a creditor's interest in a debtor's collateral. This form is essential for establishing a public record of the secured party's rights. Proper completion ensures protection for both debtors and creditors in financial transactions.

Get This Form Now

Ucc 1 Louisiana Form

Get This Form Now

Don’t forget to finish your form

Finish Ucc 1 Louisiana online — fast edits, instant download.

Get This Form Now

or

↓ Ucc 1 Louisiana PDF

CHECK TO REQUEST SEARCH REPORTS ON DEBTOR(S

CHECK TO REQUEST SEARCH REPORTS ON DEBTOR(S