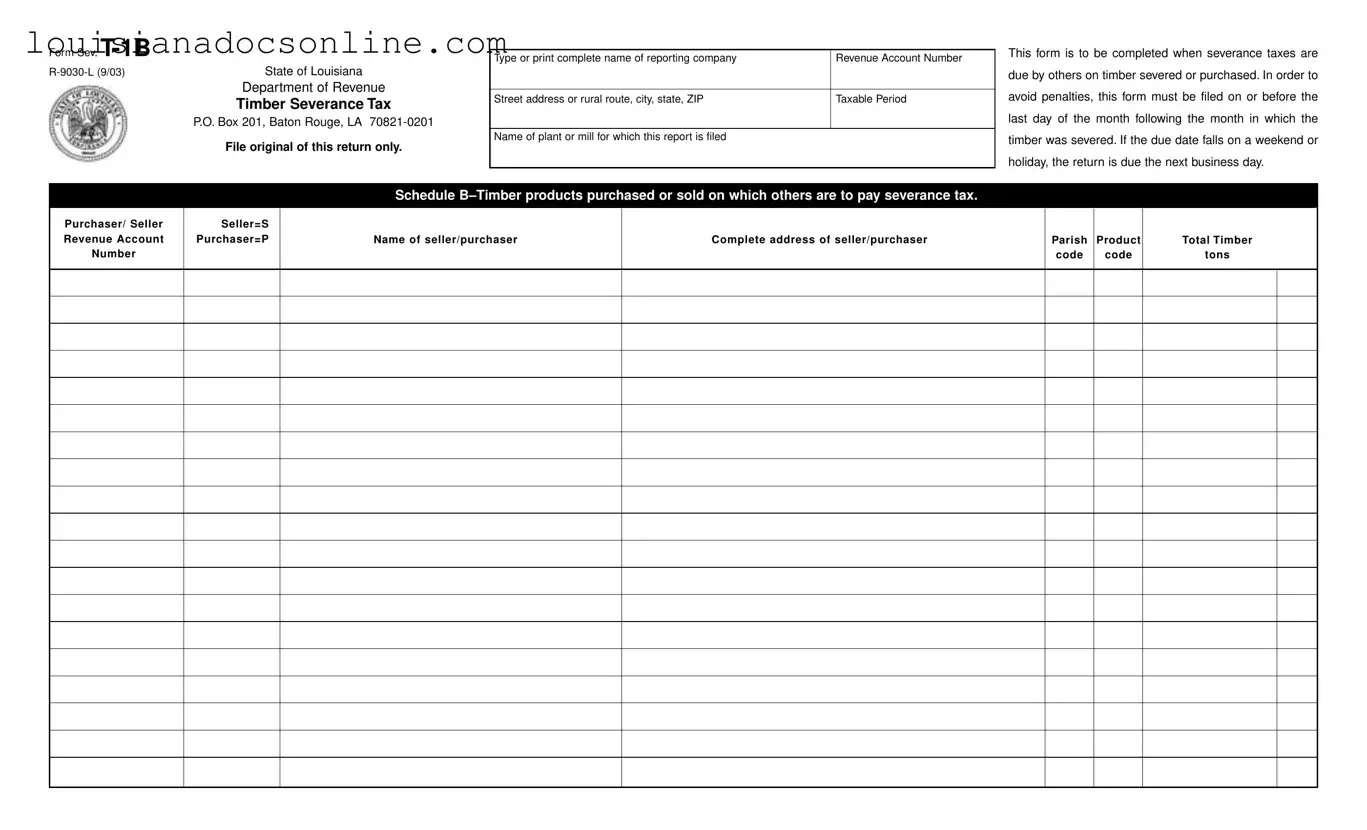

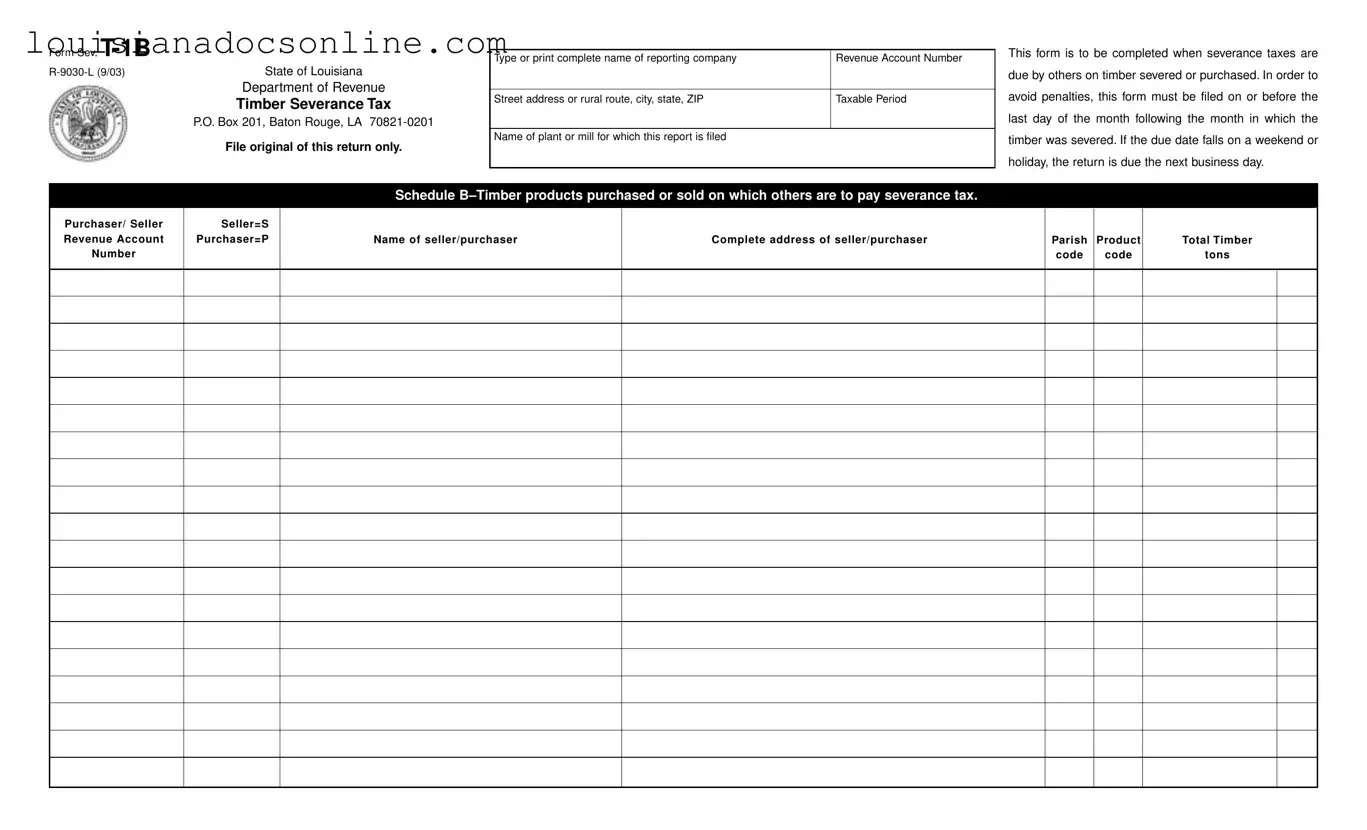

T 1B Louisiana Form

The T 1B Louisiana form is a crucial document used for reporting timber severance taxes in the state of Louisiana. It must be completed by those responsible for paying severance taxes on timber that has been severed or purchased. Timely filing is essential to avoid penalties, with the form due by the last day of the month following the severance.

Get This Form Now

T 1B Louisiana Form

Get This Form Now

Don’t forget to finish your form

Finish T 1B Louisiana online — fast edits, instant download.

Get This Form Now

or

↓ T 1B Louisiana PDF