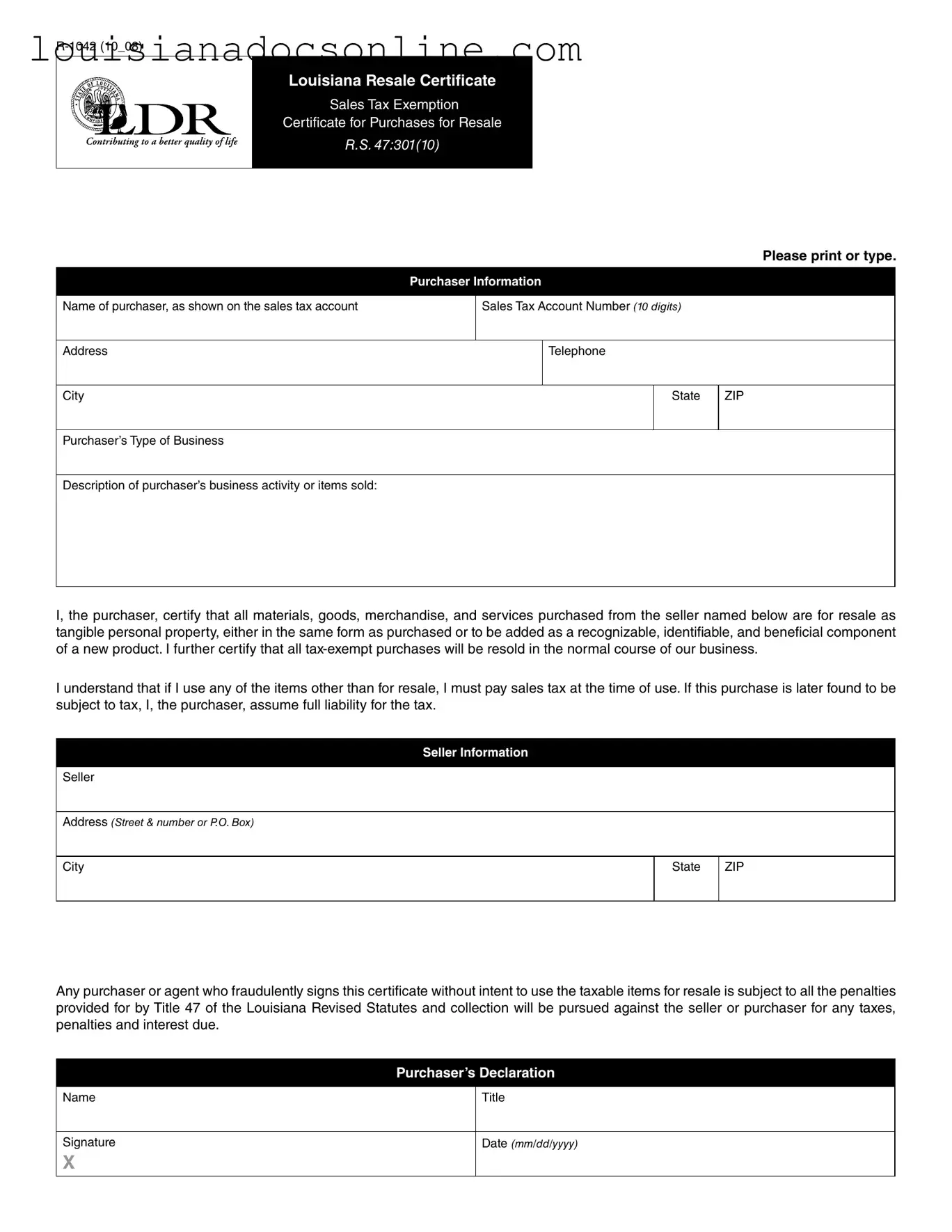

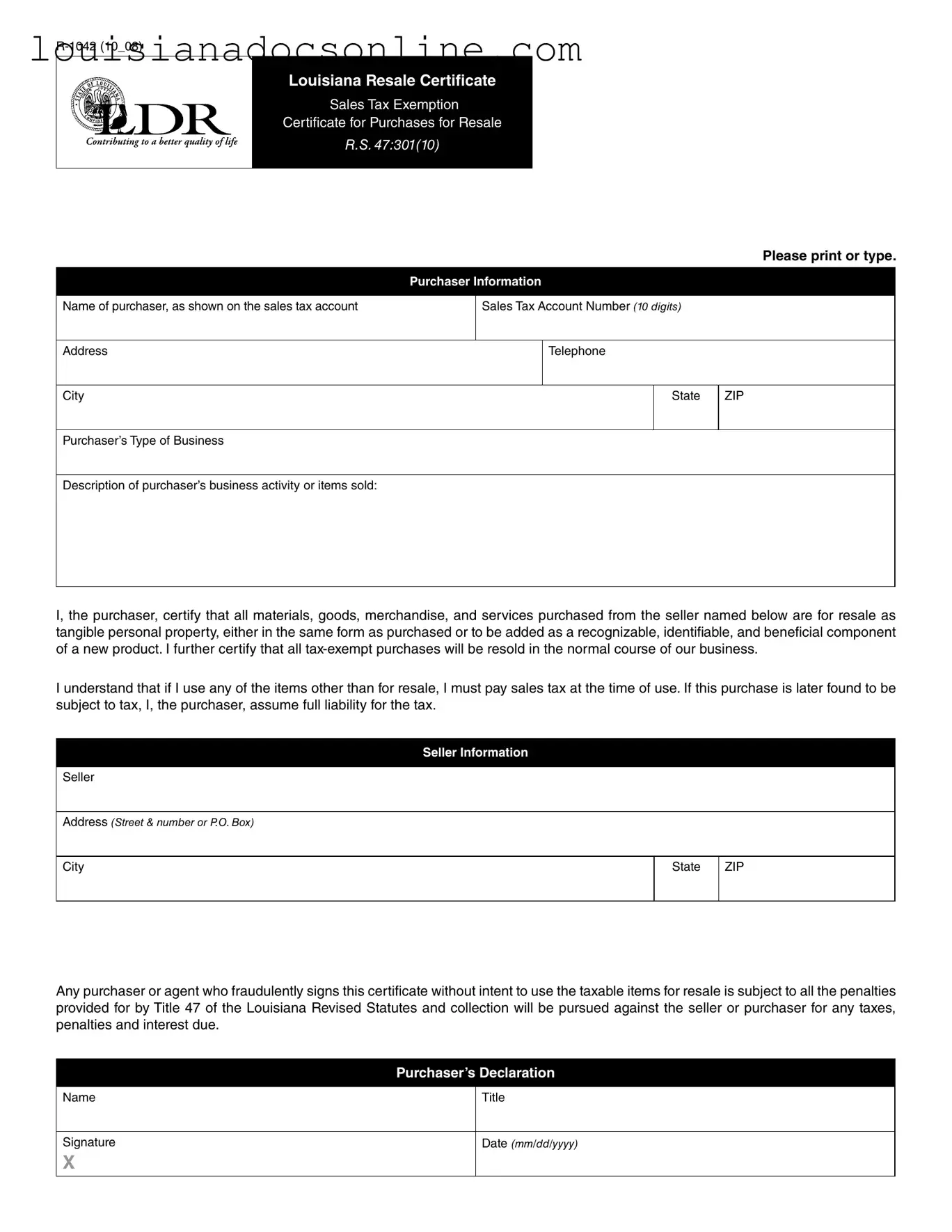

R 1042 Louisiana Certificate Form

The R 1042 Louisiana Certificate form serves as a Sales Tax Exemption Certificate for businesses purchasing goods for resale. This document is crucial for ensuring that purchasers can acquire materials without incurring sales tax, provided those items will be sold in the normal course of business. Proper completion of the form is essential to avoid potential penalties and tax liabilities.

Get This Form Now

R 1042 Louisiana Certificate Form

Get This Form Now

Don’t forget to finish your form

Finish R 1042 Louisiana Certificate online — fast edits, instant download.

Get This Form Now

or

↓ R 1042 Louisiana Certificate PDF