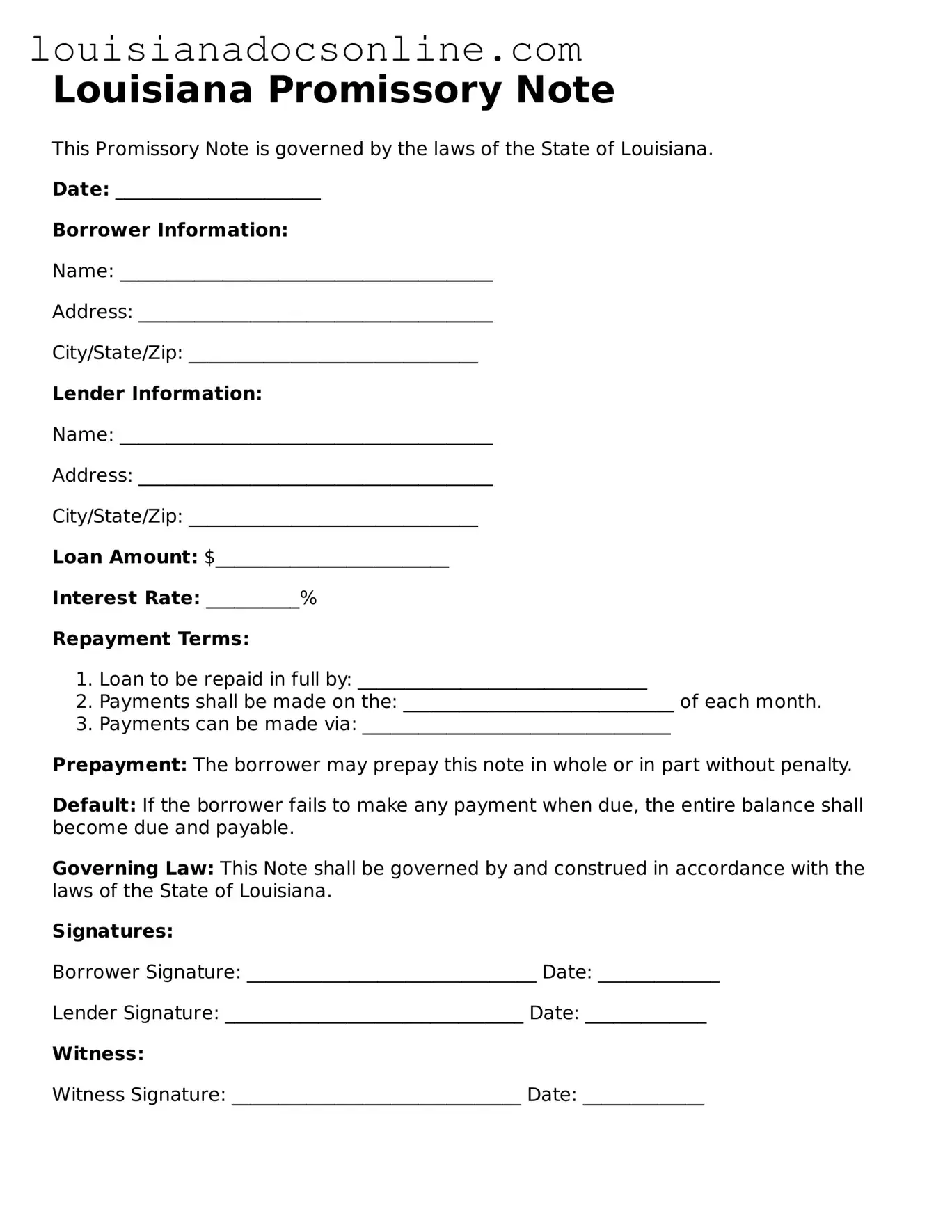

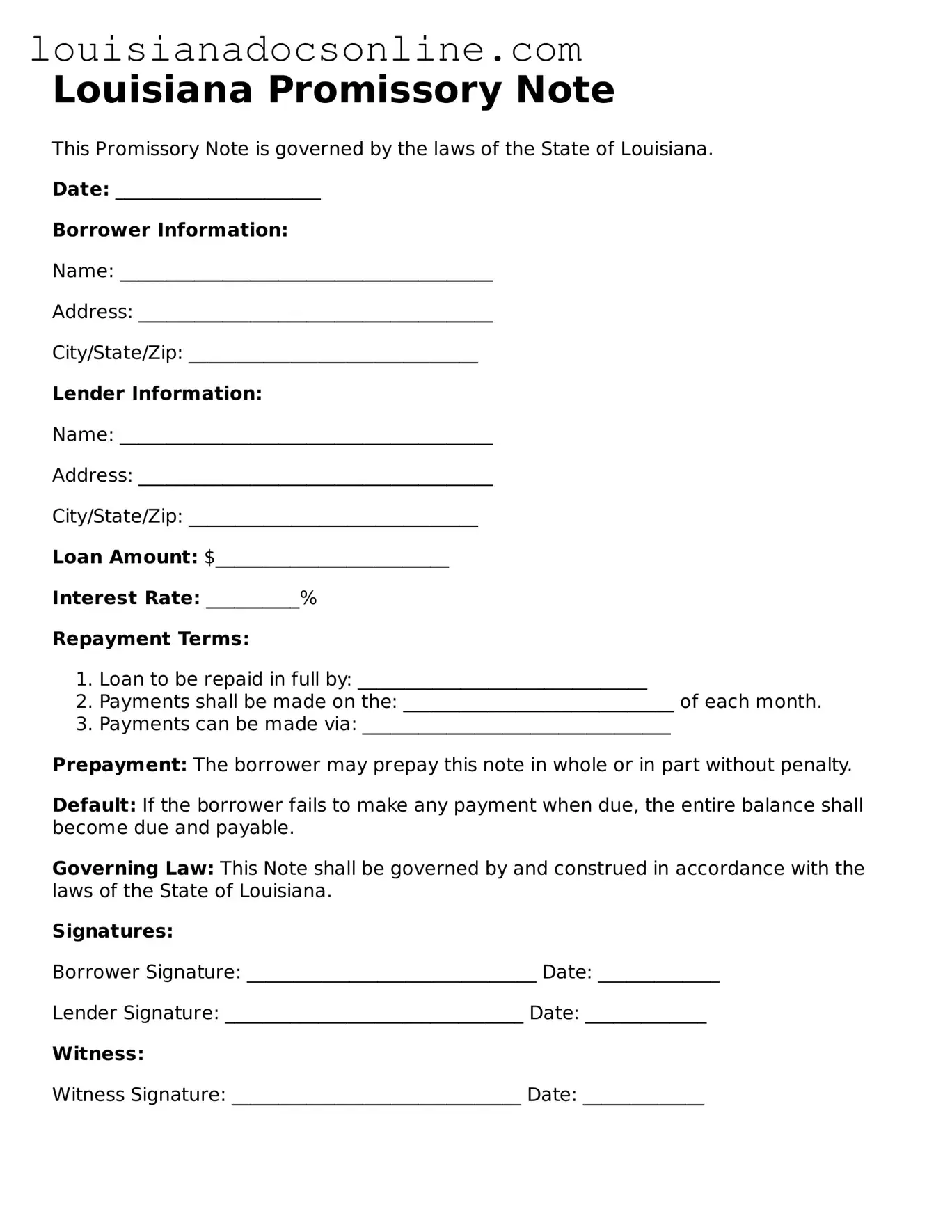

Printable Promissory Note Form for Louisiana

A Louisiana Promissory Note is a legal document in which one party promises to pay a specific amount of money to another party under agreed-upon terms. This form serves as a written record of the debt, outlining the repayment schedule and interest rates, if applicable. Understanding this document is essential for both lenders and borrowers to ensure clarity and enforceability of the agreement.

Get This Form Now

Printable Promissory Note Form for Louisiana

Get This Form Now

Don’t forget to finish your form

Finish Promissory Note online — fast edits, instant download.

Get This Form Now

or

↓ Promissory Note PDF