|

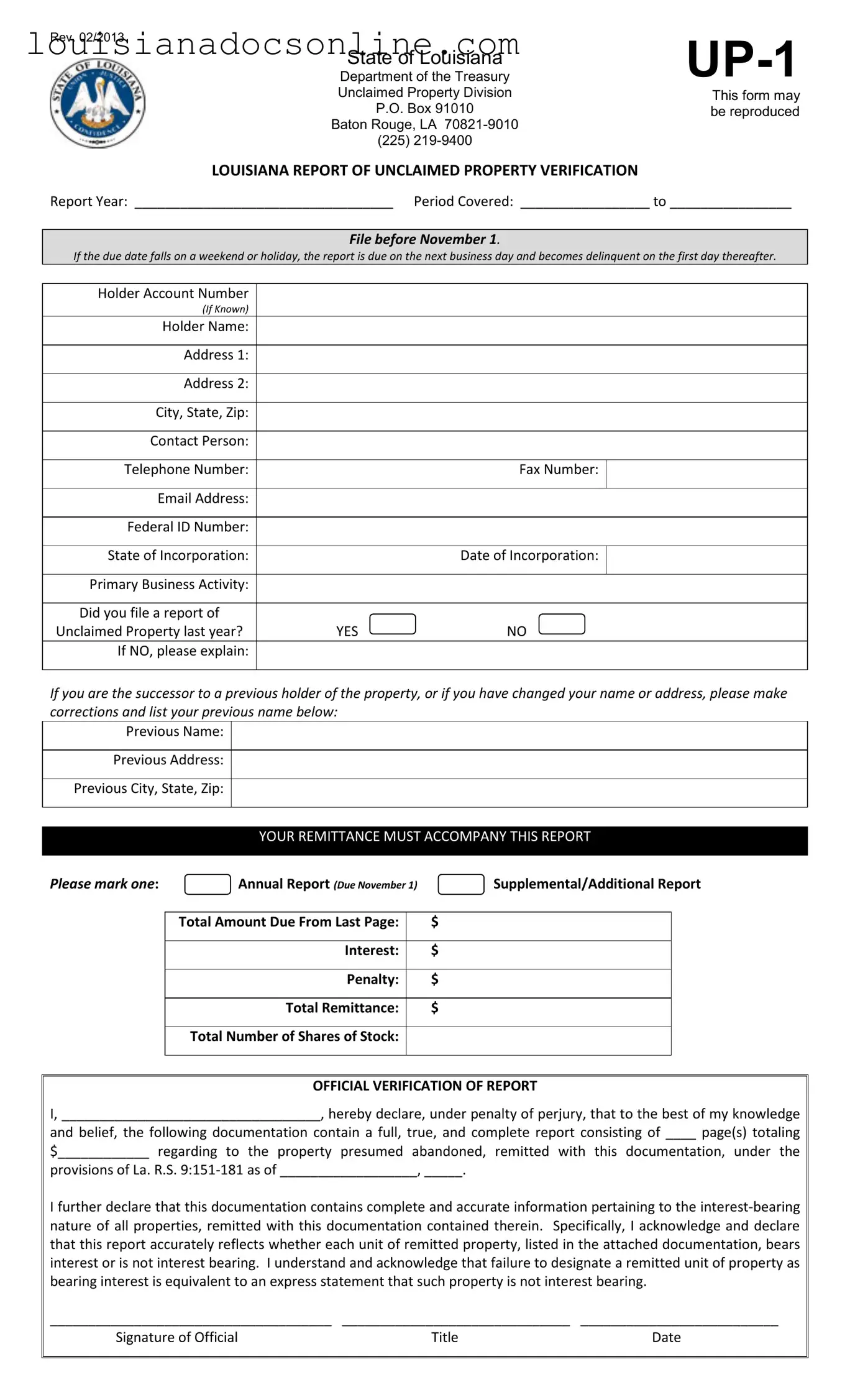

Rev. 02/2013 |

UP-1 |

|

State of Louisiana |

|

|

|

Department of the Treasury |

|

|

Unclaimed Property Division |

This form may |

|

P.O. Box 91010 |

be reproduced |

|

Baton Rouge, LA 70821-9010 |

|

|

(225) 219-9400 |

|

|

LOUISIANA REPORT OF UNCLAIMED PROPERTY VERIFICATION |

|

Report Year: __________________________________ Period Covered: _________________ to ________________

FILE BEFORE NOVEMBER 1.

If the due date falls on a weekend or holiday, the report is due on the next business day and becomes delinquent on the first day thereafter.

Holder Account Number |

|

|

|

(If Known) |

|

|

|

Holder Name: |

|

|

|

|

|

|

|

Address 1: |

|

|

|

|

|

|

|

Address 2: |

|

|

|

|

|

|

|

City, State, Zip: |

|

|

|

|

|

|

|

Contact Person: |

|

|

|

|

|

|

|

Telephone Number: |

|

Fax Number: |

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

Federal ID Number: |

|

|

|

|

|

|

State of Incorporation: |

|

Date of Incorporation: |

|

|

|

|

|

Primary Business Activity: |

|

|

|

|

|

|

|

Did you file a report of |

|

|

|

Unclaimed Property last year? |

YES |

NO |

|

|

|

|

If NO, please explain: |

|

|

|

|

|

|

|

If you are the successor to a previous holder of the property, or if you have changed your name or address, please make corrections and list your previous name below:

Previous Name:

Previous Address:

Previous City, State, Zip:

YOUR REMITTANCE MUST ACCOMPANY THIS REPORT

PLEASE MARK ONE: |

Annual Report (DUE NOVEMBER 1) |

Supplemental/Additional Report |

|

|

|

|

|

|

Total Amount Due From Last Page: |

|

$ |

|

|

|

|

|

|

|

Interest: |

|

$ |

|

|

|

|

|

|

|

Penalty: |

|

$ |

|

|

|

|

|

|

|

Total Remittance: |

|

$ |

|

|

|

|

|

|

|

Total Number of Shares of Stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICIAL VERIFICATION OF REPORT

I, __________________________________, hereby declare, under penalty of perjury, that to the best of my knowledge

and belief, the following documentation contain a full, true, and complete report consisting of ____ page(s) totaling

$____________ regarding to the property presumed abandoned, remitted with this documentation, under the

provisions of La. R.S. 9:151-181 as of __________________, _____.

I further declare that this documentation contains complete and accurate information pertaining to the interest-bearing nature of all properties, remitted with this documentation contained therein. Specifically, I acknowledge and declare that this report accurately reflects whether each unit of remitted property, listed in the attached documentation, bears interest or is not interest bearing. I understand and acknowledge that failure to designate a remitted unit of property as bearing interest is equivalent to an express statement that such property is not interest bearing.

_____________________________________ |

______________________________ |

__________________________ |

Signature of Official |

Title |

Date |

|

|

|