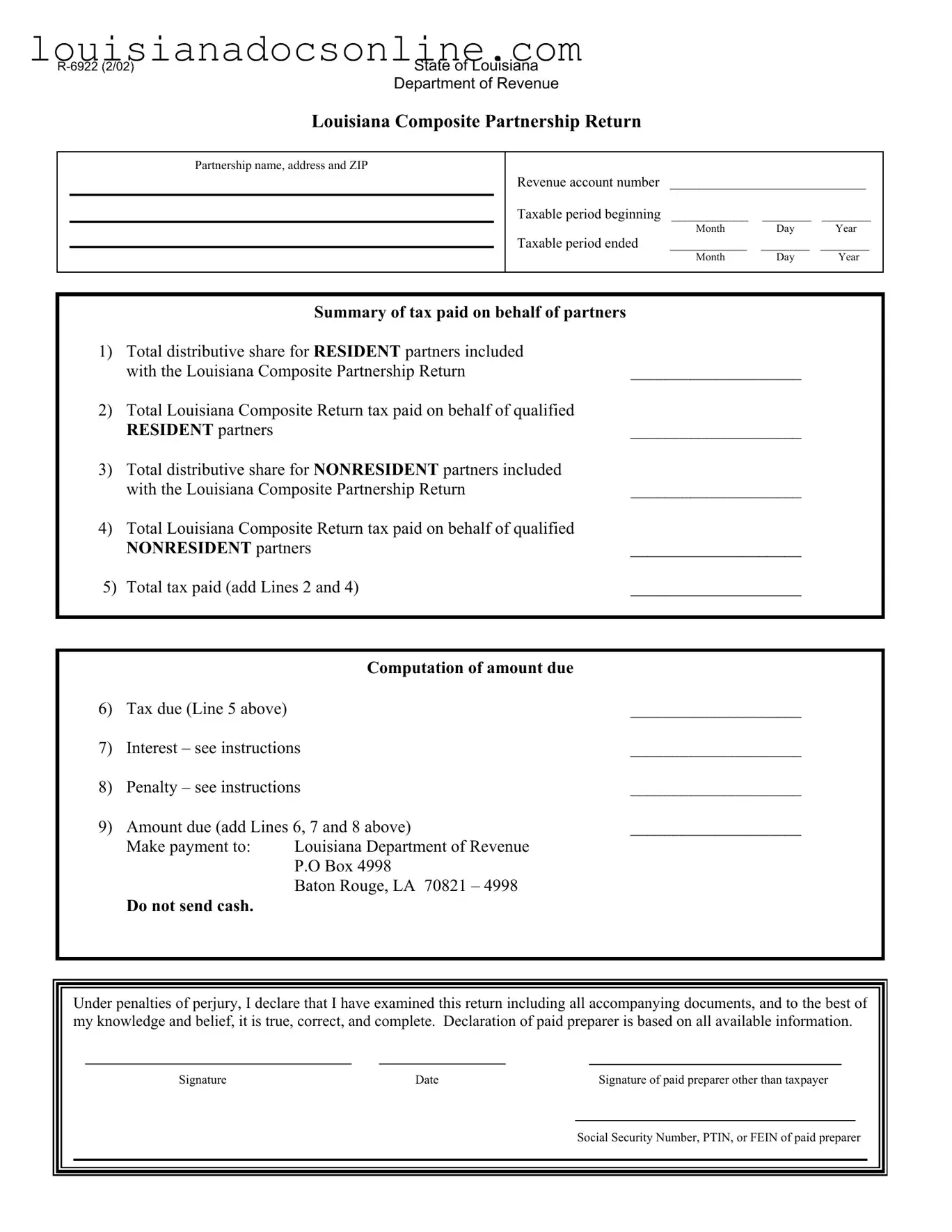

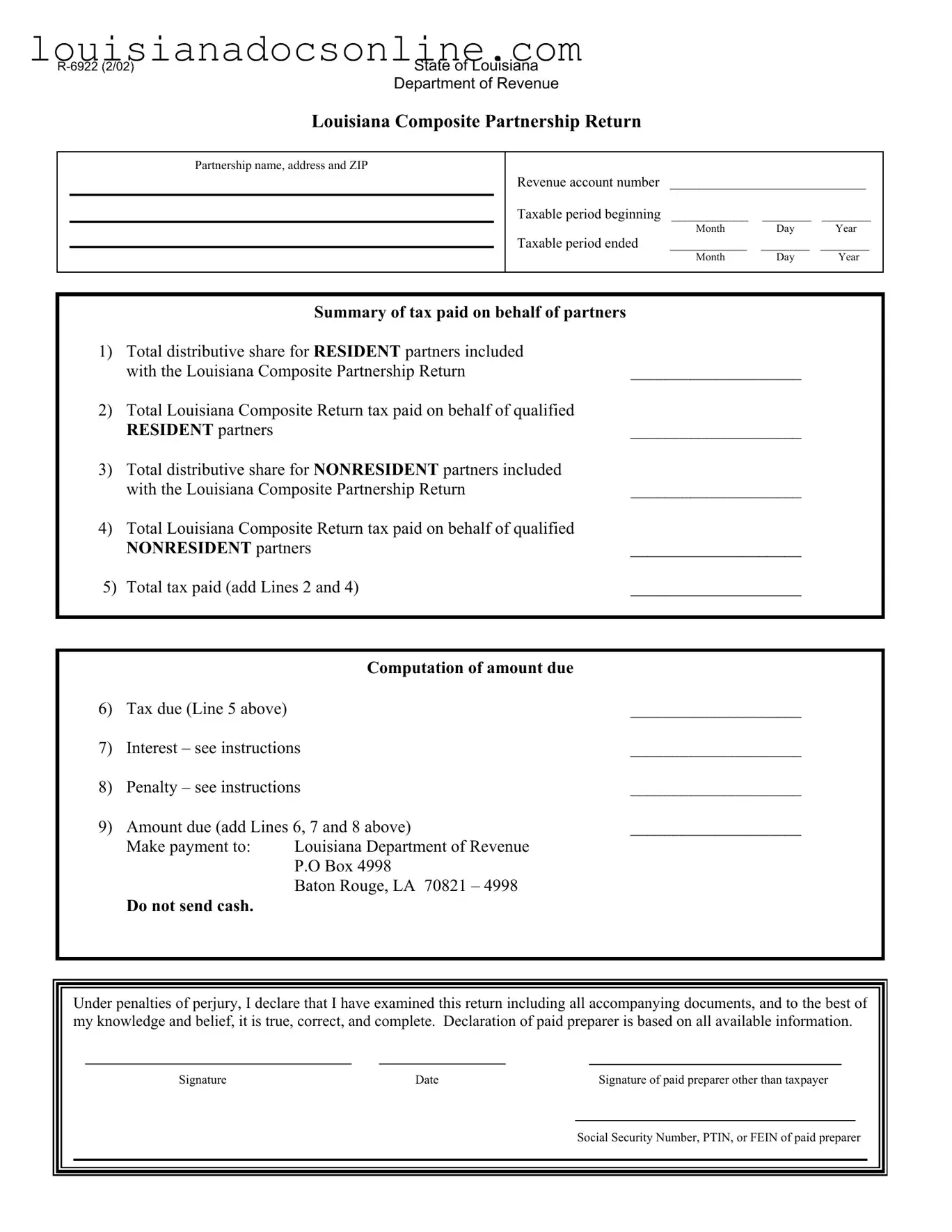

Louisiana R 6922 Form

The Louisiana R 6922 form serves as the official document for filing the Louisiana Composite Partnership Return. This form is essential for partnerships operating in Louisiana, as it outlines the tax obligations for both resident and nonresident partners. By accurately completing the R 6922, partnerships ensure compliance with state tax regulations and facilitate the proper distribution of tax responsibilities among partners.

Get This Form Now

Louisiana R 6922 Form

Get This Form Now

Don’t forget to finish your form

Finish Louisiana R 6922 online — fast edits, instant download.

Get This Form Now

or

↓ Louisiana R 6922 PDF