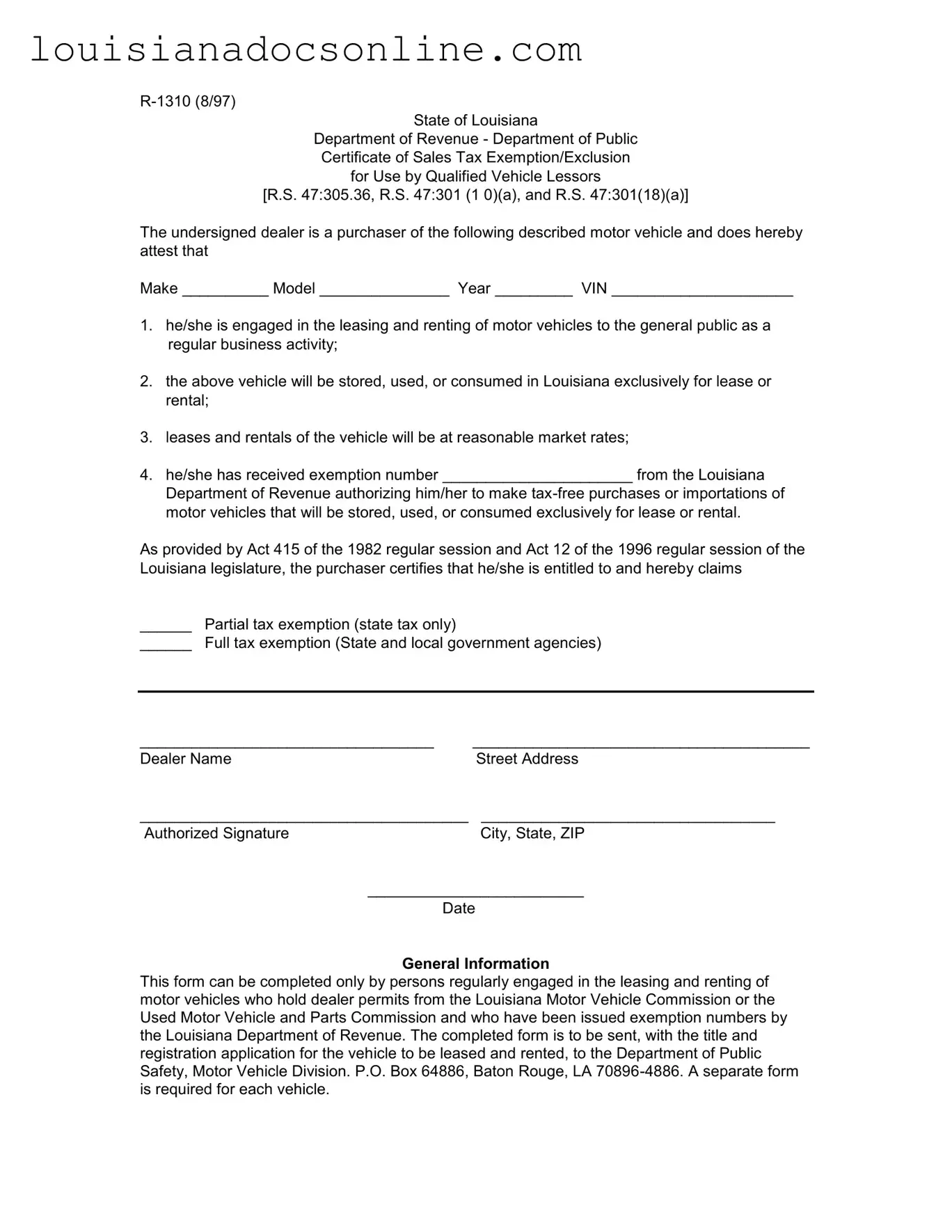

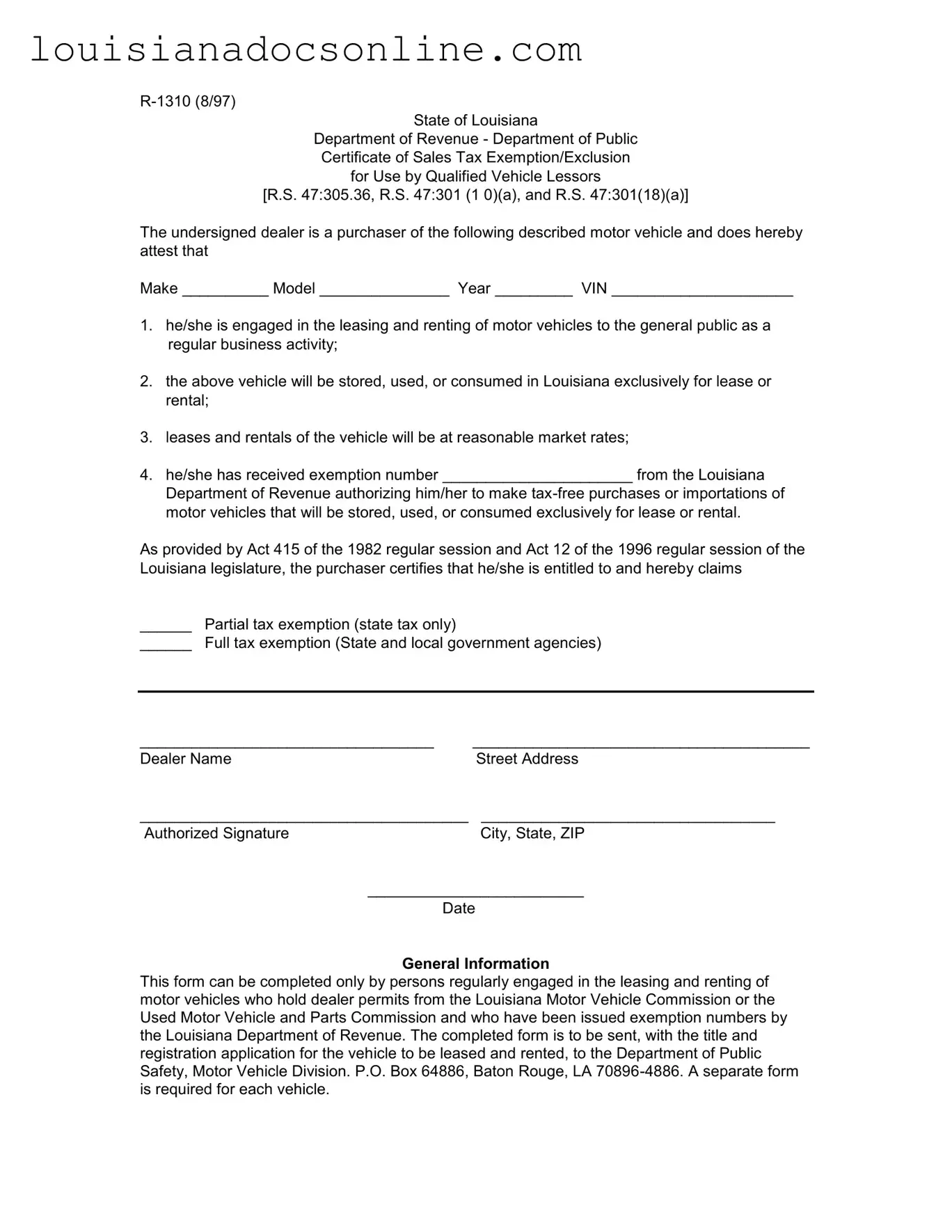

Louisiana R 1310 Form

The Louisiana R 1310 form is a document used by qualified vehicle lessors to claim sales tax exemptions for motor vehicles intended for lease or rental. This form certifies that the dealer engages in leasing activities and provides details about the vehicle in question. It is essential for those in the vehicle leasing business to understand the requirements and procedures associated with this form to ensure compliance with state regulations.

Get This Form Now

Louisiana R 1310 Form

Get This Form Now

Don’t forget to finish your form

Finish Louisiana R 1310 online — fast edits, instant download.

Get This Form Now

or

↓ Louisiana R 1310 PDF