R-1086 (1/18)

|

|

|

|

|

|

FILING PERIOD |

|

|

|

|

|

S o l a r E n e rgy I n c o m e Ta x C re d i t fo r |

2017 |

|

|

|

|

|

I n d i v i d u a l s a n d B u s i n e s s e s |

|

|

|

|

|

|

|

|

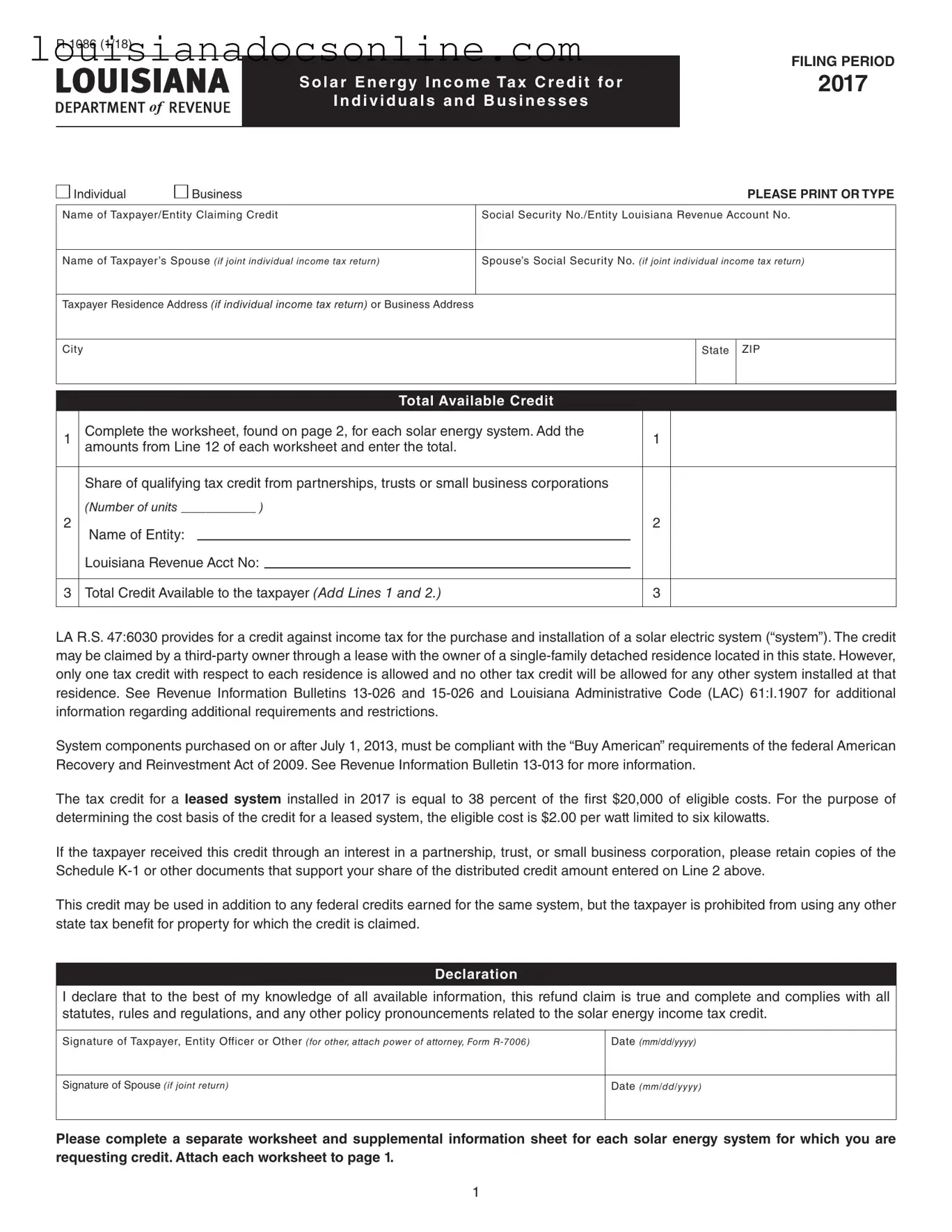

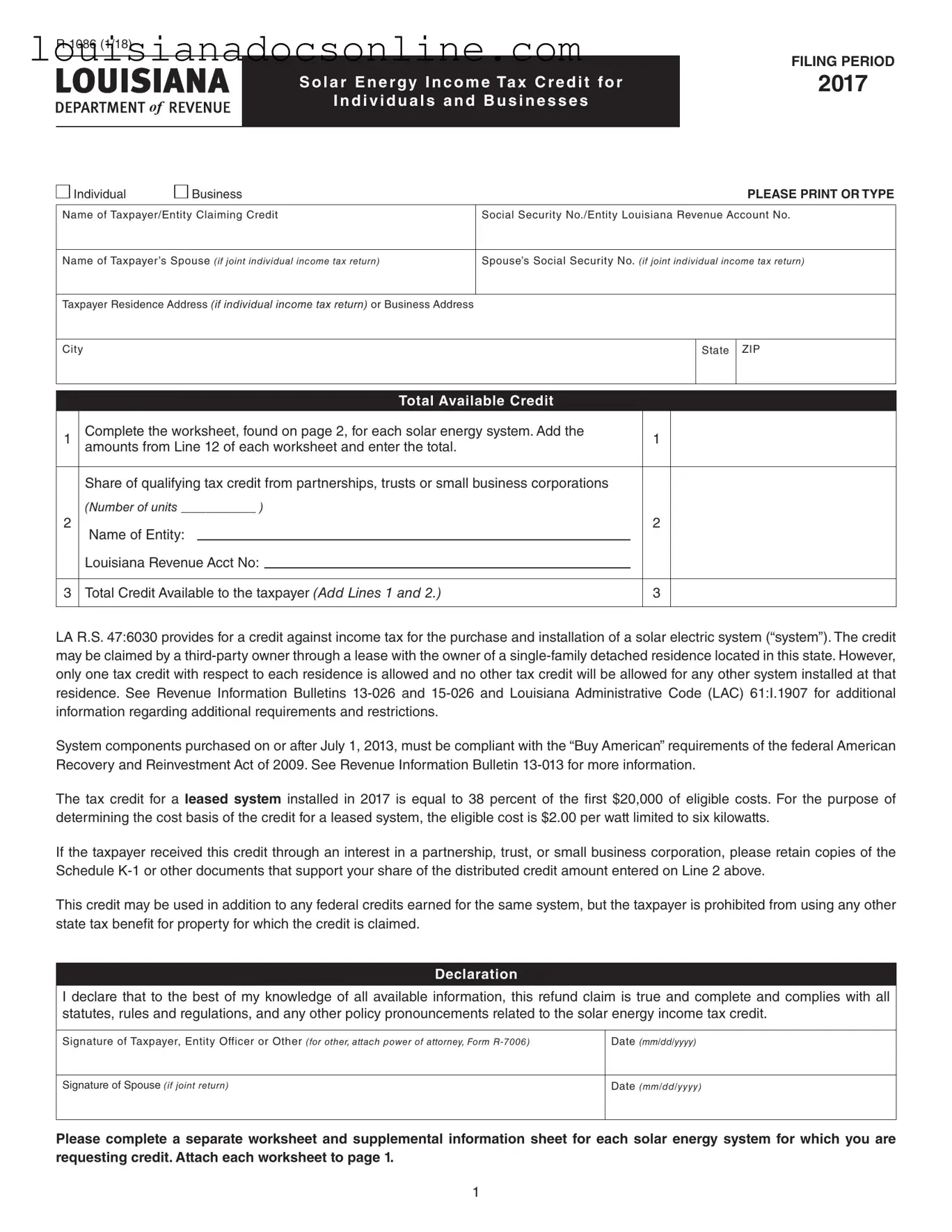

Individual |

Business |

PLEASE PRINT OR TYPE |

Name of Taxpayer/Entity Claiming Credit

Social Security No./Entity Louisiana Revenue Account No.

Name of Taxpayer’s Spouse (if joint individual income tax return)

Spouse’s Social Security No. (if joint individual income tax return)

Taxpayer Residence Address (if individual income tax return) or Business Address

|

|

|

Total Available Credit |

|

|

1 |

Complete the worksheet, found on page 2, for each solar energy system. Add the |

1 |

|

amounts from Line 12 of each worksheet and enter the total. |

|

|

|

|

|

|

|

|

|

Share of qualifying tax credit from partnerships, trusts or small business corporations |

|

|

|

(Number of units ____________ ) |

|

|

2 |

Name of Entity: |

|

|

2 |

|

|

|

|

|

Louisiana Revenue Acct No: |

|

|

|

|

|

|

|

|

|

3 |

Total Credit Available to the taxpayer (Add Lines 1 and 2.) |

3 |

|

|

|

|

|

|

|

|

LA R.S. 47:6030 provides for a credit against income tax for the purchase and installation of a solar electric system (“system”). The credit may be claimed by a third-party owner through a lease with the owner of a single-family detached residence located in this state. However, only one tax credit with respect to each residence is allowed and no other tax credit will be allowed for any other system installed at that residence. See Revenue Information Bulletins 13-026 and 15-026 and Louisiana Administrative Code (LAC) 61:I.1907 for additional information regarding additional requirements and restrictions.

System components purchased on or after July 1, 2013, must be compliant with the “Buy American” requirements of the federal American Recovery and Reinvestment Act of 2009. See Revenue Information Bulletin 13-013 for more information.

The tax credit for a leased system installed in 2017 is equal to 38 percent of the first $20,000 of eligible costs. For the purpose of determining the cost basis of the credit for a leased system, the eligible cost is $2.00 per watt limited to six kilowatts.

If the taxpayer received this credit through an interest in a partnership, trust, or small business corporation, please retain copies of the Schedule K-1 or other documents that support your share of the distributed credit amount entered on Line 2 above.

This credit may be used in addition to any federal credits earned for the same system, but the taxpayer is prohibited from using any other state tax benefit for property for which the credit is claimed.

Declaration

I declare that to the best of my knowledge of all available information, this refund claim is true and complete and complies with all statutes, rules and regulations, and any other policy pronouncements related to the solar energy income tax credit.

Signature of Taxpayer, Entity Officer or Other (for other, attach power of attorney, Form R-7006)

Signature of Spouse (if joint return)

Please complete a separate worksheet and supplemental information sheet for each solar energy system for which you are requesting credit. Attach each worksheet to page 1.

R-1086 (1/18)

|

|

|

|

|

|

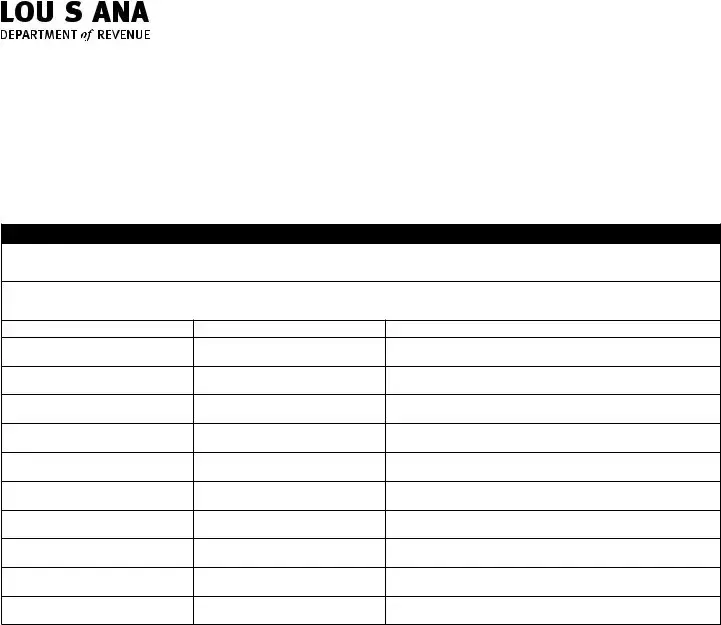

Solar Energy |

|

|

FILING PERIOD |

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

Income Tax Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT OR TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer/Entity Claiming Credit |

|

Social Security No./ Louisiana Revenue Account No. |

|

|

|

|

|

|

|

|

|

|

|

Physical Address of Location Where System Installed |

|

City |

State |

ZIP |

|

|

|

|

|

|

|

|

|

LA |

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer’s Spouse (if joint return) |

|

Spouse’s Social Security No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

System Information

Total nameplate listed kW of all installed panels:

Provide the make, model, and serial number of generators, alternators, turbines, photovoltaic panels, and inverters for which a credit is being applied.

Attach Additional Sheets if Needed

LAC 61:I.1907 requires certain information about the system be provided to determine eligibility for the credit. Below is a list of additional information required about the solar system. Failure to provide this information shall result in the disallowance of the credit.

1.A copy of the modeled array output report using the PV Watts Solar System Performance Calculator. The calculator was developed by the National Renewable Energy Laboratory and is available at the website www.pvwatts.nrel.gov. The analysis must be performed using the default PV Watts de-rate factor.

2.A copy of the solar site shading analysis conducted on the installation site using a recognized industry site assessment tool such as a Solar Pathfinder or Solmetric demonstrating the suitability of the site for installation of a solar energy system.

3.A copy of the installation contract signed by the taxpayer and a copy of the receipt or paid invoice detailing the amount of purchase.

R-1086 (1/18)

|

|

|

|

|

|

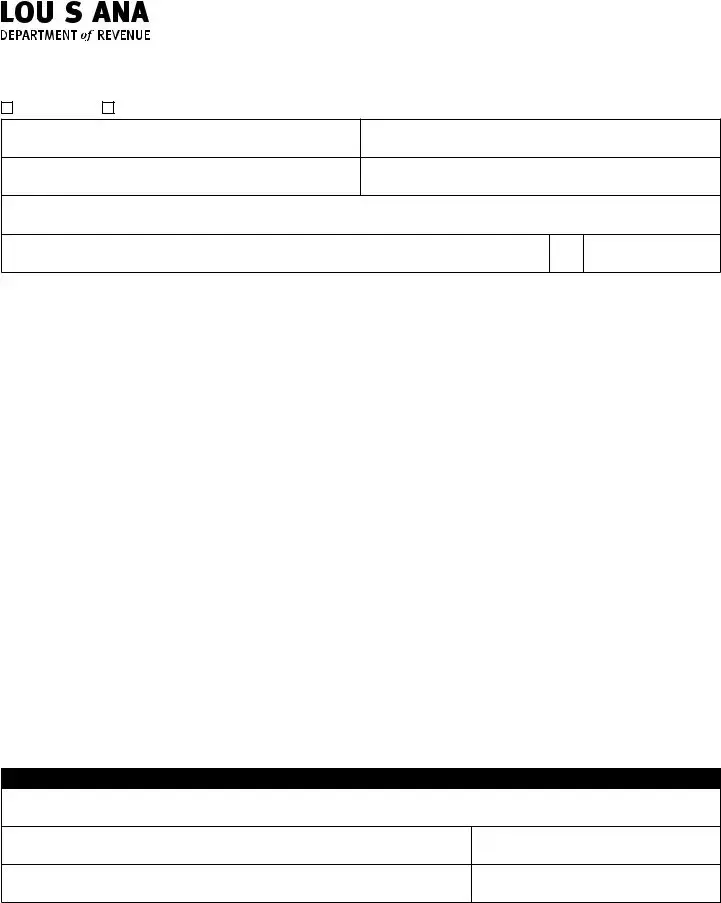

Solar Energy |

|

|

FILING PERIOD |

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

Income Tax Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential Property Owner Declaration |

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT OR TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer/Entity Claiming Credit |

|

Social Security No./ Louisiana Revenue Account No. |

|

|

|

|

|

|

|

|

|

|

|

Physical Address of Location Where System Installed |

|

City |

State |

ZIP |

|

|

|

|

|

|

|

|

|

LA |

|

|

|

|

|

|

|

|

|

|

|

|

Name of Taxpayer’s Spouse (if joint return) |

|

Spouse’s Social Security No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

This page must be signed by the owner of the property on which the solar system is installed.

I, the undersigned residential property owner, am the lessee of a solar energy system and may be entitled to claim the Louisiana solar energy income tax credit pursuant to R.S. 47:6030.

I understand and acknowledge my right to consult a tax professional prior to claiming any Louisiana state tax credit for which I may be eligible.

I understand and acknowledge that LAC 61:I.1907(F)(2) and (3) provide costs ineligible for inclusion under the tax credit. I understand that R.S. 47:6030(C)(1) explains that my “cost of purchase” or overall “costs” of a solar energy system cannot include any lease management fee or any inducement to lease a solar energy system.

I understand that an inducement is an incentive for me to lease a solar energy system. An inducement may be offered to me as a rebate, prize, gift certificate, trip, additional energy item or service, or any other thing of value given to me by the seller, installer, or equipment manufacturer as an incentive for me to lease a system.

Whenever marketing rebates or incentives are offered to me in return for a reduction in the lease price of the system or as an inducement to lease, the eligible cost under LAC 61:I.1907(F)(1) will be accordingly reduced by the fair market value of the marketing rebate or incentive that I receive.

Date (mm/dd/yyyy) |

Last 4 Digits of SSN |

Signature |

_______ _______ _______ _______

Print Name

R-1086-B (1/18)

|

|

|

|

|

|

FILING PERIOD |

|

|

|

|

|

Sworn Statements by Licensed |

2017 |

|

|

|

|

|

Dealer and Installer |

|

|

|

|

|

|

|

|

Pursuant to Revised Statute (R.S.) 47:6030(D)(3)(d), Form R-1086 shall contain the following sworn statements by the licensed dealer who leased the system and the licensed installer who installed the system. This page must be completed in its entirety and included with Form R-1086.

Residential Property where the Solar Energy System was Installed

To Be Completed by Dealer:

The undersigned is an authorized principal in _______________________________________________________, is licensed by the

Louisiana Board of Contractors as required by R.S. 47:6030, and certifies under penalty of law, particularly R.S. 14:202.2(A), that the

system leased to the homeowner of the residence located at ___________________________________________________ has a total

nameplate value of ___________________ kilowatts, that no solar dealer, solar installer, or installer affiliate financed the repayment

obligations, and that a reasonable good faith belief exists that the residence is eligible for the credit provided for in this Section in the

amount claimed on a Louisiana income tax return.

___________________________________________________ |

__________________________________ |

______________ |

Dealer’s Name (printed) |

Dealer’s Name (signature) |

Date |

___________________________________________________ |

__________________________________ |

_______________ |

Dealer’s Louisiana License Number |

Notary Public |

Date |

To Be Completed by Installer:

The undersigned is an authorized principal in ______________________________________________________________________,

is licensed by the Louisiana Board of Contractors as required by R.S. 47:6030, is a licensed installer, as required by R.S. 37:2156.3, and certifies under penalty of law, particularly R.S. 14:202.2(A), that the system installed at the residence located at ____________________

______________________________________________________ has a total nameplate value of _____________ kilowatts.

|

|

|

|

___________________________________________________ |

___________________________________ |

_______________ |

Installer’s Name (printed) |

Installer’s Name (signature) |

Date |

___________________________________________________ |

___________________________________________________ |

Installer’s Louisiana License Number |

Date the installation of the energy system was completed and placed in service |

___________________________________________________ |

_______________ |

|

Notary Public |

Date |

|