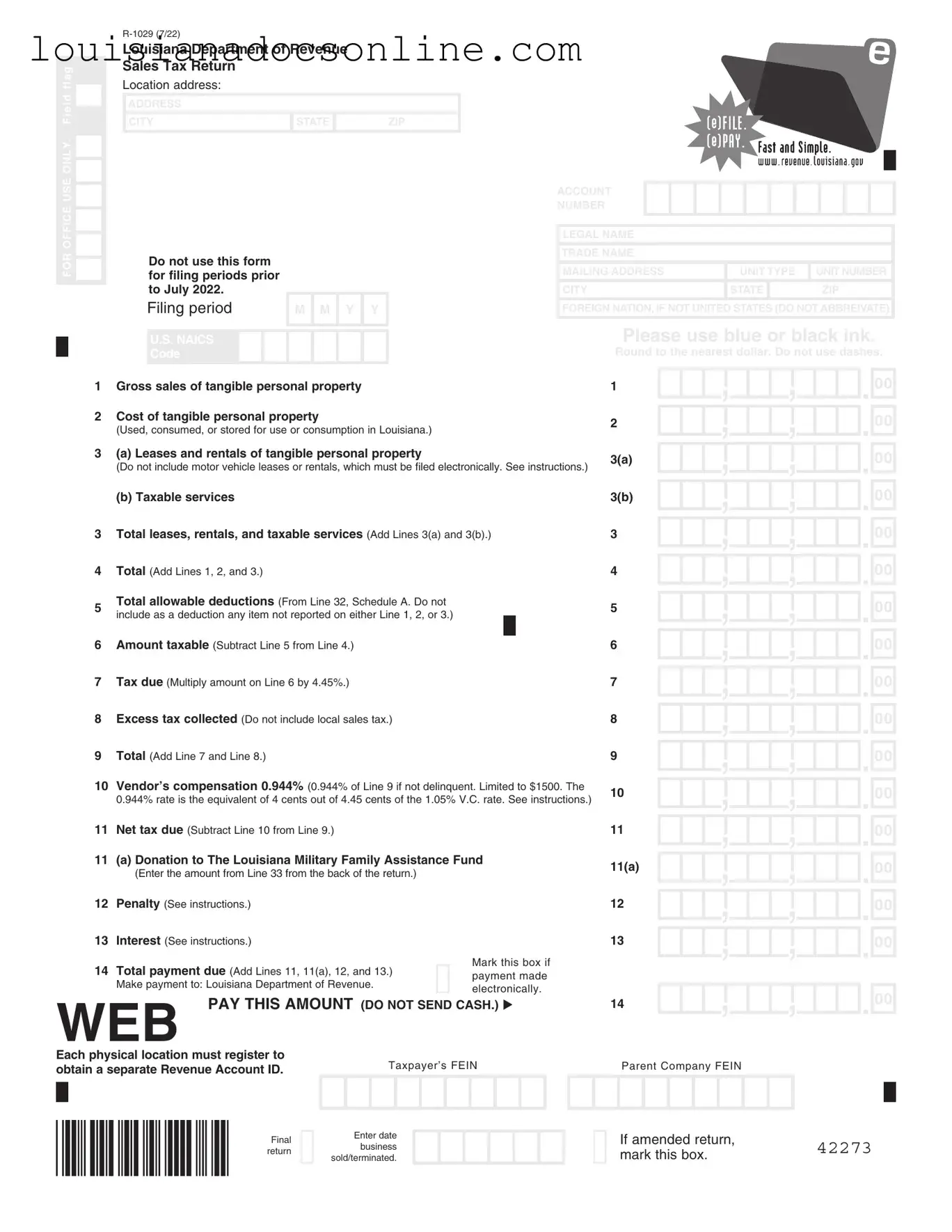

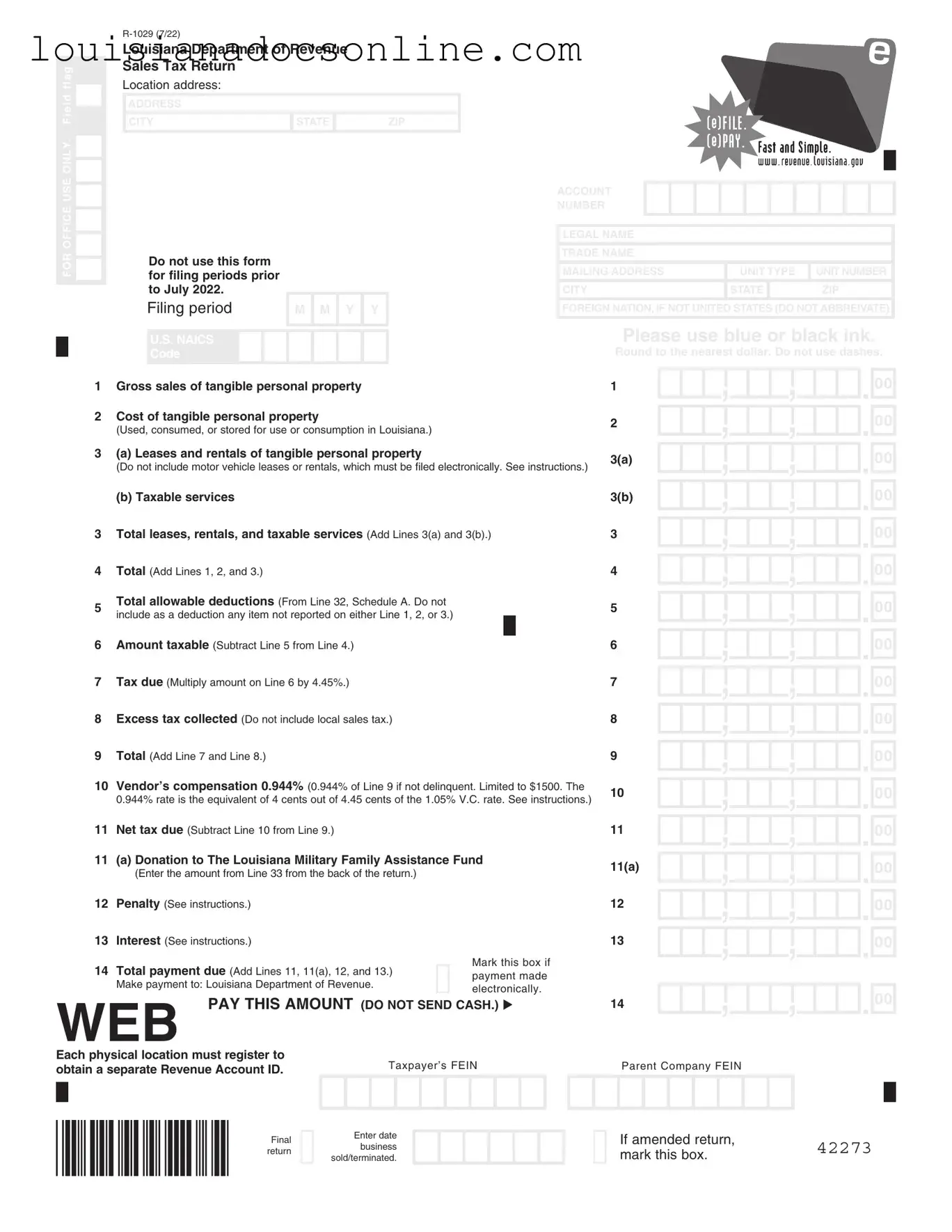

Louisiana 1029 Sales Form

The Louisiana 1029 Sales Form is a crucial document used for reporting sales tax in the state of Louisiana. Designed for businesses, this form captures essential financial information, including gross sales and allowable deductions, ensuring compliance with state tax regulations. Understanding how to accurately complete this form is vital for maintaining good standing with the Louisiana Department of Revenue.

Get This Form Now

Louisiana 1029 Sales Form

Get This Form Now

Don’t forget to finish your form

Finish Louisiana 1029 Sales online — fast edits, instant download.

Get This Form Now

or

↓ Louisiana 1029 Sales PDF