LOUISIANA FILE ONLINE

Fast. Easy. Absolutely Free.

revenue.louisiana.gov/fileonline

Are you due a refund? If you file this paper return, it will take up to 14 weeks to get your refund check. With Louisiana File Online and direct deposit, you can receive your refund within 45 days.

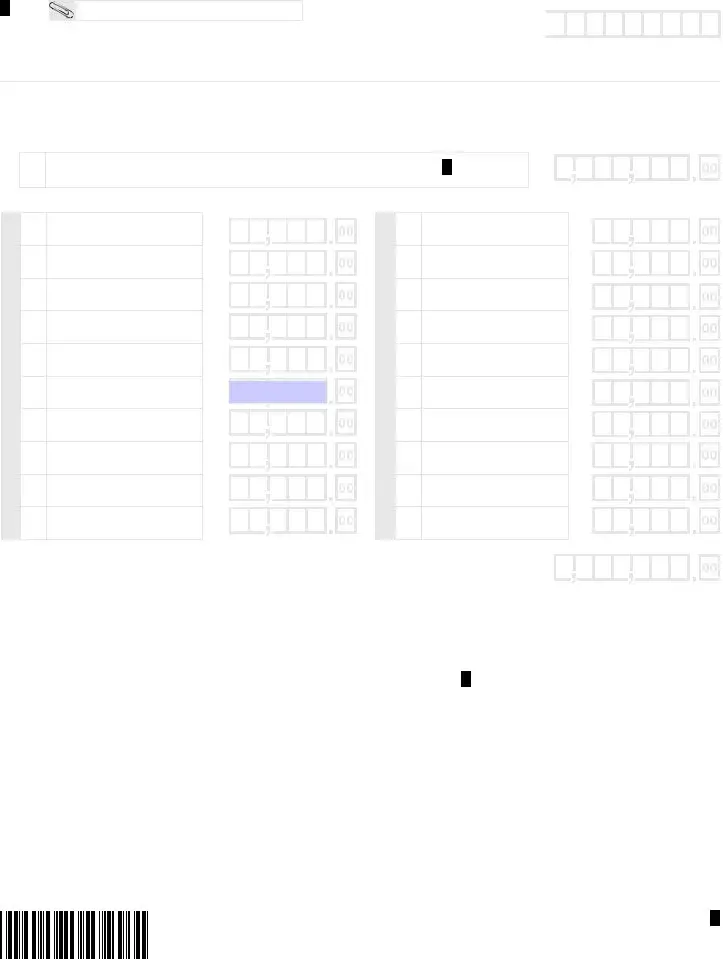

2022 Form IT-540-WEB (Page 2 of 4)

Enter your Social Security Number.

If you are not required to file a federal |

|

Mark this box and enter zero “0” on Line 12. |

|

|

return, indicate wages here. |

|

|

|

|

|

|

|

7 |

FEDERAL ADJUSTED GROSS INCOME – If your Federal Adjusted |

|

From Louisiana |

|

Schedule E, |

Gross Income is less than zero, enter “0.” |

|

|

|

attached |

|

|

|

If you did not itemize your deductions on your federal return, leave Lines 8A through 8D blank and go to Line 9.

8A |

FEDERAL ITEMIZED DEDUCTIONS |

|

|

8B |

FEDERAL ITEMIZED DEDUCTION FOR MEDICAL AND DENTAL EXPENSES |

|

|

8C |

FEDERAL STANDARD DEDUCTION |

|

|

8D |

EXCESS FEDERAL ITEMIZED DEDUCTIONS – Subtract Line 8C from Line 8B. |

9YOUR LOUISIANA TAX TABLE INCOME – Subtract Line 8D from Line 7. If less than zero, enter “0.” Use this figure to find your tax in the tax tables.

10YOUR LOUISIANA INCOME TAX – Enter the amount from the tax table that corresponds with your filing status.

11NONREFUNDABLE PRIORITY 1 CREDITS – From Schedule C, Line 6

12TAX LIABILITY AFTER NONREFUNDABLE PRIORITY 1 CREDITS – Subtract Line 11 from Line 10. If the result is less than zero, or you are not required to file a federal return, enter zero “0.”

|

2022 LOUISIANA REFUNDABLE CHILD CARE CREDIT – Your Federal Adjusted Gross Income |

|

13 |

must be EQUAL TO OR LESS THAN $25,000 to claim the credit on this line. See the instructions |

13 |

|

and the Refundable Child Care Credit Worksheet. |

|

|

|

|

|

|

|

13A |

Enter the qualified expense amount from the |

Refundable |

Child Care Credit |

Worksheet, Line 3. |

13A |

|

|

|

|

|

13B |

13B |

Enter the amount from the Refundable Child Care Credit Worksheet, Line 6. |

|

|

|

|

|

|

|

2022 LOUISIANA REFUNDABLE SCHOOL READINESS CREDIT – Your Federal Adjusted Gross |

|

|

Income must be EQUAL TO OR LESS THAN $25,000 to claim the credit on this line. See the |

|

14 |

Refundable School Readiness Credit Worksheet. |

|

|

|

|

|

|

14 |

|

5 |

|

|

4 |

|

|

3 |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

15 |

EARNED INCOME CREDIT – See Louisiana Earned Income Credit (LA EIC) Worksheet, Line 3. |

|

|

|

|

|

|

16 |

OTHER REFUNDABLE PRIORITY 2 CREDITS – From Schedule F, Line 9 |

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

TOTAL REFUNDABLE PRIORITY 2 CREDITS – Add Lines 13, and 14 through 16. Do not include |

17 |

amounts on Lines 13A and 13B. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18TAX LIABILITY AFTER REFUNDABLE PRIORITY 2 CREDITS

19OVERPAYMENT AFTER REFUNDABLE PRIORITY 2 CREDITS

20NONREFUNDABLE PRIORITY 3 CREDITS – From Schedule J, Line 16

Enter the first 4 letters of your last name in these boxes.

18

19

20

CONTINUE ON NEXT PAGE.

WEB 62331

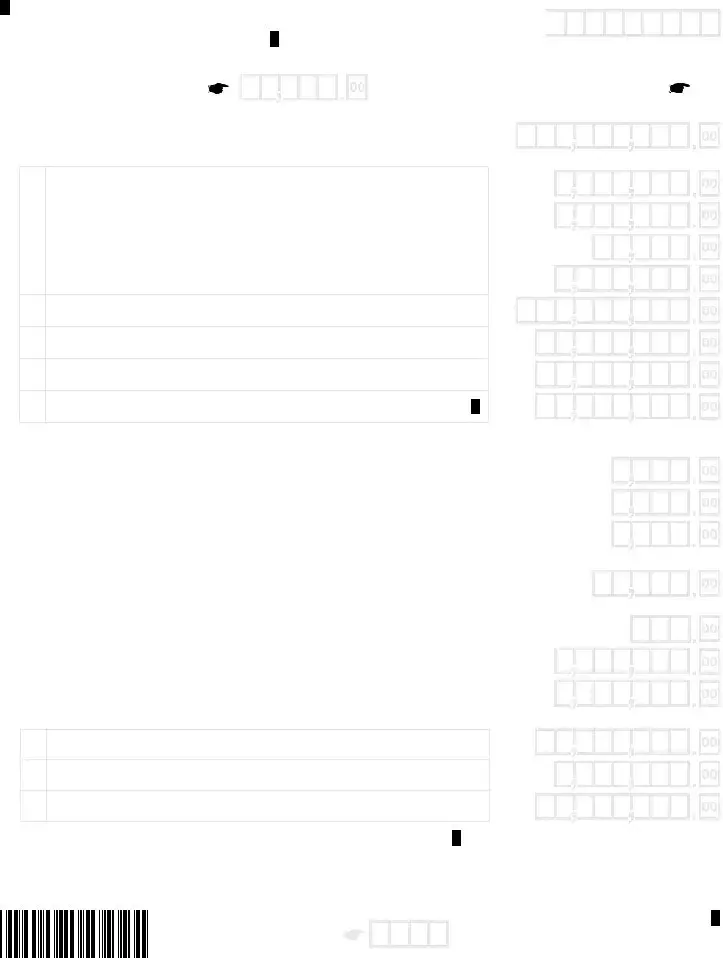

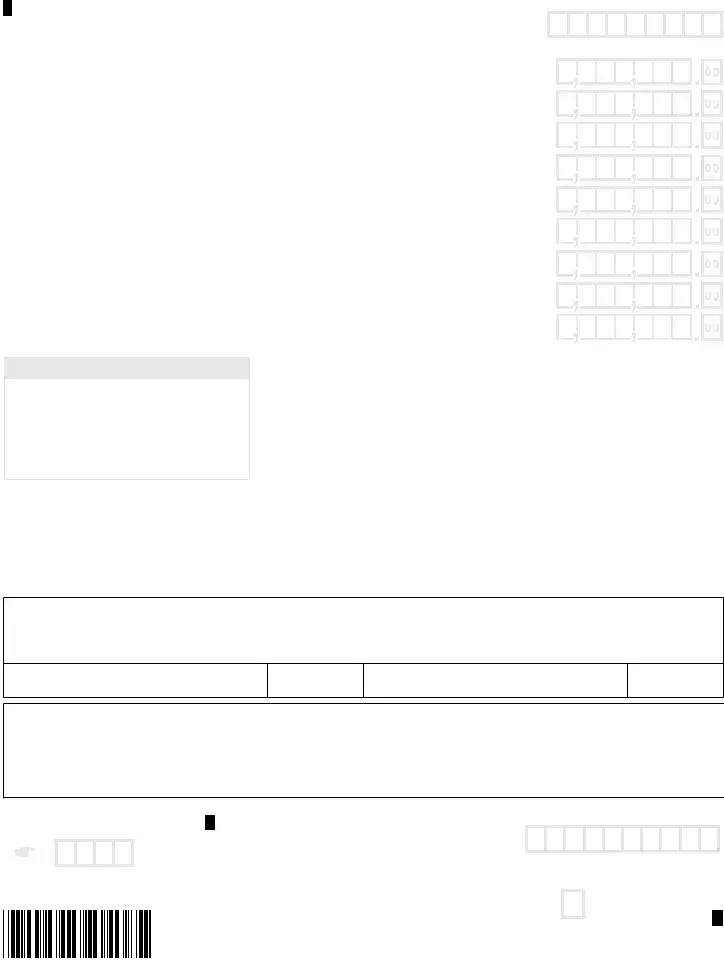

2022 Form IT-540-WEB (Page 3 of 4)

Enter your Social Security Number.

21 |

ADJUSTED LOUISIANA INCOME TAX – Subtract Line 20 from Line 18. |

|

|

|

|

|

|

|

|

|

No use tax due. |

|

|

|

|

22 |

CONSUMER USE TAX - You must mark one of these boxes. |

|

|

Amount from the Consumer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Tax Worksheet. |

|

|

|

|

|

|

|

|

|

|

23TOTAL INCOME TAX AND CONSUMER USE TAX – Add Lines 21 and 22.

24OVERPAYMENT OF REFUNDABLE PRIORITY 2 CREDITS – Enter the amount from Line 19.

25REFUNDABLE PRIORITY 4 CREDITS – From Schedule I, Line 6

26 AMOUNT OF LOUISIANA TAX WITHHELD FOR 2022 – Attach Forms W-2 and 1099. |

26 |

PAYMENTS |

27 |

AMOUNT OF CREDIT CARRIED FORWARD FROM 2021 |

27 |

|

|

|

|

28 |

|

28 |

AMOUNT OF ESTIMATED PAYMENTS MADE FOR 2022 |

|

|

|

29 |

|

29 |

AMOUNT OF EXTENSION PAYMENT |

|

|

30 TOTAL REFUNDABLE TAX CREDITS AND PAYMENTS – Add Lines 24 through 29.

31OVERPAYMENT – If Line 30 is greater than Line 23, subtract Line 23 from Line 30. Your overpayment may be reduced by the Underpayment of Estimated Tax Penalty. Otherwise, go to Line 38.

32UNDERPAYMENT PENALTY – See the instructions for Underpayment Penalty and Form R-210R. If you are a farmer, check the box.

33ADJUSTED OVERPAYMENT – If Line 31 is greater than Line 32, subtract Line 32 from Line 31, and enter on Line 33. If Line 32 is greater than Line 31, subtract Line 31 from Line 32, and enter the balance on Line 38.

34TOTAL DONATIONS – From Schedule D, Line 22

35 |

SUBTOTAL – Subtract Line 34 from Line 33. This amount of overpayment is available for credit or refund. |

35 |

|

|

|

|

36 |

AMOUNT OF LINE 35 TO BE CREDITED TO 2023 INCOME TAX |

CREDIT |

36 |

AMOUNT TO BE REFUNDED – Subtract Line 36 from Line 35. If mailing to LDR, use Address 2 on the next page.

37 Enter a “2” in box if you want to receive your refund by paper check. |

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter a “3” in box if you want to receive your refund by direct deposit. Complete |

REFUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

information below. If information is unreadable, you are filing for the first time, or if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

you do not make a refund selection, you will receive your refund by paper check. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECT DEPOSIT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type: |

Checking |

|

|

|

|

Savings |

|

|

Will this refund be forwarded to a financial |

|

Yes |

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

institution located outside the United States? |

|

|

|

|

|

|

|

|

|

|

Routing |

|

|

|

|

|

|

|

|

|

|

|

Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter the first 4 letters of your last name in these boxes.

COMPLETE AND SIGN RETURN ON NEXT PAGE.

WEB 62332

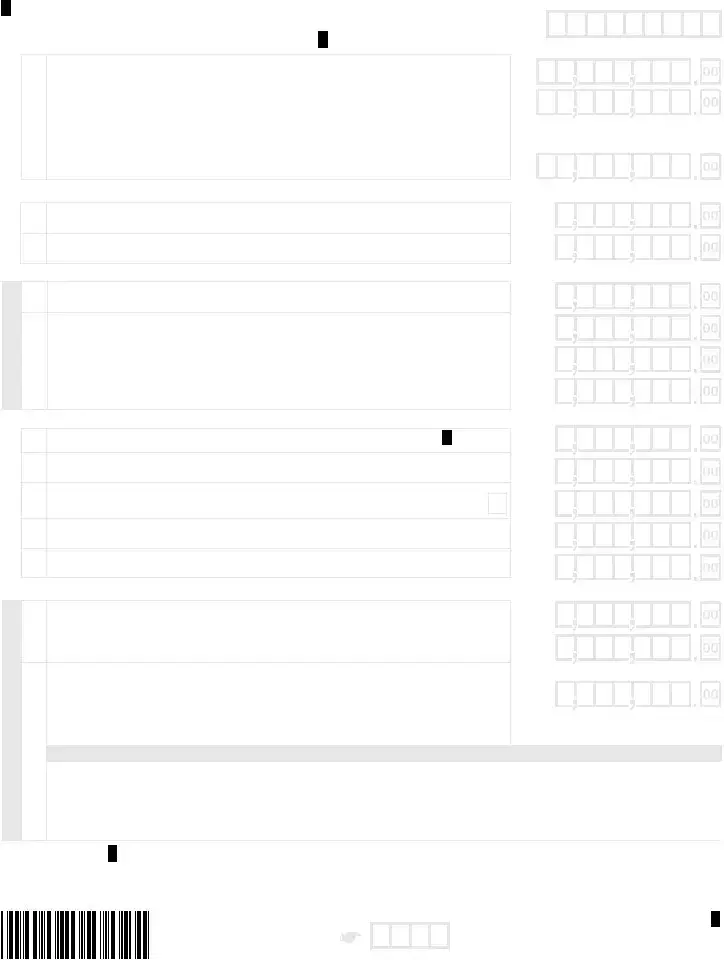

2022 Form IT-540-WEB (Page 4 of 4)

Enter your Social Security Number.

|

|

38 |

AMOUNT YOU OWE – If Line 23 is greater than Line 30, subtract Line 30 from Line 23. |

|

|

|

|

|

|

|

|

|

|

|

39 |

ADDITIONAL DONATION TO THE MILITARY FAMILY ASSISTANCE FUND |

|

|

|

|

|

|

LOUISIANA |

|

|

|

|

|

40 |

ADDITIONAL DONATION TO THE COASTAL PROTECTION AND RESTORATION FUND |

|

|

|

|

|

|

|

|

|

41 |

ADDITIONAL DONATION TO LOUISIANA FOOD BANK ASSOCIATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42 |

INTEREST – From the Interest Calculation Worksheet, Line 5. |

|

|

|

|

|

|

DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

DELINQUENT FILING PENALTY – From the Delinquent Filing Penalty Calculation Worksheet, Line 3. |

|

AMOUNTS |

|

|

|

|

|

|

44 |

DELINQUENT PAYMENT PENALTY – From Delinquent Payment Penalty Calculation Worksheet, Line 7. |

|

|

|

|

|

|

|

|

45 |

UNDERPAYMENT PENALTY – See the instructions for Underpayment Penalty and Form R-210R. |

|

|

|

|

|

|

|

If you are a farmer, check the box. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE DUE LOUISIANA – Add Lines 38 through 45. |

PAY THIS AMOUNT. |

|

|

46 |

If mailing to LDR, use address 1 below. For electronic payment |

|

|

|

options, see instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT!

All four (4) pages of this return

MUST be mailed in together along

with your W-2s and completed schedules. Please paperclip.

Do not staple.

38

39

40

41

42

43

44

45

46

DO NOT SEND CASH.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. If I made a contribution to a START Savings Program, I consent that my Social Security Number may be given to the Louisiana Office of Student Financial Assistance to properly identify the START Savings Program account holder. If married filing jointly, both Social Security Numbers may be submitted. I understand that by submitting this form I authorize the disbursement of individual income tax refunds through the method as described on Line 37.

Spouse’s Signature (If filing jointly, both must sign.)

Print/Type Preparer’s Name |

Preparer’s Signature |

Date (mm/dd/yyyy) |

Check if Self-employed |

|

|

|

|

|

Firm’s Name ➤ |

|

|

Firm’s FEIN ➤ |

|

|

|

|

|

|

Firm’s Address ➤ |

|

|

Telephone ➤ |

|

|

|

|

|

|

Enter the first 4 letters of your last name in these boxes.

{ A d d r e s s }

|

Individual Income Tax Return |

|

Calendar year return due 5/15/2023 |

|

|

1 |

Mail Balance Due Return with Payment |

TO: Department of Revenue |

P. O. Box 3550 |

|

Baton Rouge, LA 70821-3550 |

2 |

Mail All Other Individual Income Tax Returns |

TO: Department of Revenue |

P. O. Box 3440 |

|

Baton Rouge, LA 70821-3440 |

PTIN, FEIN, or LDR Account Number

of Paid Preparer

WEB

For Office |

|

Use Only. |

62333 |

|

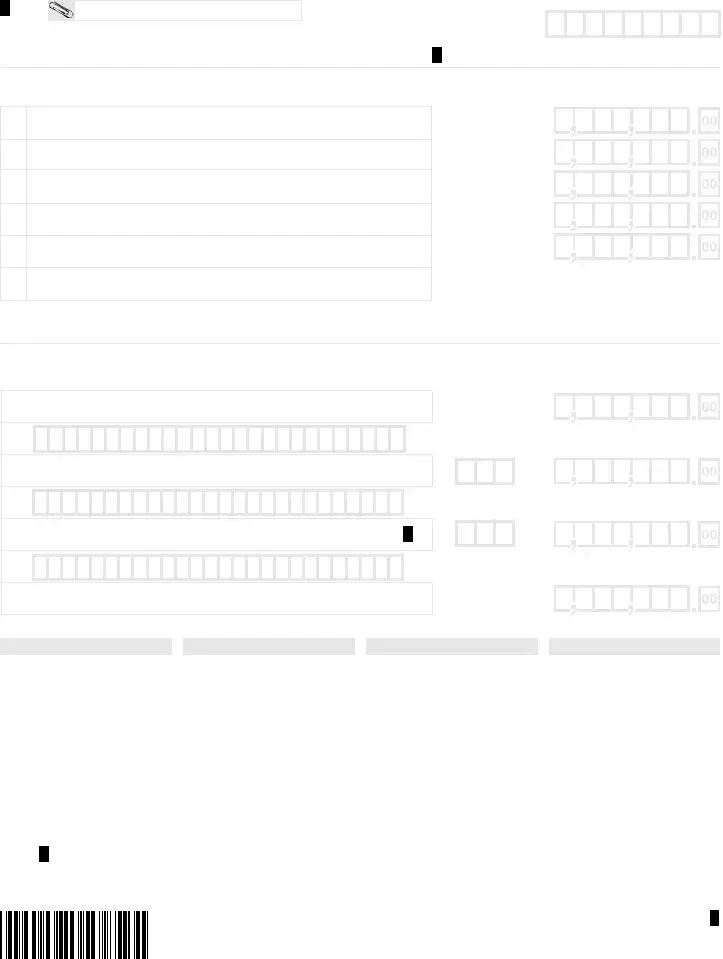

ATTACH TO RETURN IF COMPLETED.

Enter your Social Security Number.

SCHEDULE C – 2022 NONREFUNDABLE PRIORITY 1 CREDITS

1CREDIT FOR TAX LIABILITIES PAID TO OTHER STATES – A copy of the return filed with the other states and Form R-10606 must be submitted with this schedule.

|

1A |

Enter the total of Net Tax Liability Paid to Other States from Form R-10606. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1B |

Enter the Credit for Taxes Paid to Other States from Form R-10606. |

|

|

|

|

|

|

|

|

|

Additional Nonrefundable Priority 1 Credits

Enter credit description and associated code, along with the dollar amount of credit claimed. See the instructions.

Credit Description |

Credit Code |

Amount of Credit Claimed |

2

3

4

5

6TOTAL NONREFUNDABLE PRIORITY 1 CREDITS – Add Lines 1B, and 2 through 5. Also, enter this amount on Form IT-540, Line 11.

Description |

Code |

Premium Tax |

100 |

|

|

Bone Marrow |

120 |

|

|

Description |

Code |

Qualified Playgrounds |

150 |

|

|

Debt Issuance |

155 |

|

|

Description |

Code |

Other |

199 |

|

|

File

electronically!

www.revenue.louisiana.gov/fileonline

ATTACH TO RETURN IF COMPLETED.

Enter your Social Security Number.

SCHEDULE D – 2022 DONATION SCHEDULE

Individuals who file an individual income tax return and have overpaid their tax may choose to donate all or part of their overpayment shown on Line 33 of Form IT-540 to the organizations or funds listed below. Enter on Lines 2 through 21, the portion of the overpayment you wish to donate. The total on Line 22 cannot exceed the amount of your overpayment on Line 33 of Form IT-540.

Adjusted Overpayment – From IT-540, Line 33

2The Military Family Assistance Fund

3Coastal Protection and Restoration Fund

4The START Program

5Wildlife Habitat and Natural Heritage Trust Fund

6Louisiana Cancer Trust Fund

7Louisiana Pet Overpopulation Advisory Council

8Louisiana Food Bank Association

9Make-A-Wish Foundation of the Texas Gulf Coast and Louisiana

10Louisiana Association of United Ways/LA 2-1-1

11American Red Cross

12Louisiana National Guard Honor Guard for Military Funerals

13Louisiana State Troopers Charities, Inc.

14Louisiana Horse Rescue Association

15Louisiana Coalition Against Domestic Violence

16Dreams Come True, Inc.

17Sexual Trauma Awareness and Response (STAR)

Louisiana State University Agricultural

18Center Grant Walker Educational Center (4-H Camp Grant Walker)

19Maddie’s Footprints

20University of New Orleans Foundation

21Southeastern Louisiana University Foundation

12

13

14

15

16

17

18

19

20

21

|

22 |

TOTAL DONATIONS – Add Lines 2 through 21. This amount cannot be more than Line 1. Also, enter this amount |

22 |

|

on Form IT-540, Line 34. |

|

|

|

|

|

|

|

WEB 62335

ATTACH TO RETURN IF COMPLETED.

2022 Louisiana School Expense Deduction Worksheet

Your Social Security Number

I.This worksheet should be used to calculate the three School Expense Deductions listed below. Refer to Revenue Information Bulletins 09-019 and 12-008 on LDR’s website for more information. Expenses paid with amounts deducted as START K12 Savings Program Contributions are not eligible for this deduction.

1.Elementary and Secondary School Tuition – R.S. 47:297.10 provides a deduction for amounts paid during the tax year for tuition and fees required for your dependent child’s enrollment in a nonpublic elementary or secondary school that complies with the criteria set forth in Brumfield v. Dodd and Section 501(c)(3) of the Internal Revenue Code or to any public elementary or secondary laboratory school that is operated by a public college or university. The school can verify that it complies with the criteria. The deduction is equal to the actual amount of tuition and fees paid per dependent, limited to $5,000. The tuition and fees that can be deducted include amounts paid for tuition, fees, uniforms, textbooks and other supplies required by the school.

2.Educational Expenses for Home-Schooled Children – R.S. 47:297.11 provides a deduction for educational expenses paid during the tax year for home-schooling your dependent child. In order to qualify for the deduction, you must be approved by the State Board of Elementary and Secondary Education (BESE) for home-schooling. The deduction is equal to 50 percent of the actual qualified educational expenses paid for the home-schooling per dependent, limited to $5,000. Qualified educational expenses include amounts paid for the purchase of textbooks and curricula necessary for home-schooling.

3.Educational Expenses for a Quality Public Education – R.S. 47:297.12 provides a deduction for the fees or other amounts paid during the tax year for a quality education of a dependent child enrolled in a public elementary or secondary school, including Louisiana Department of Education approved charter schools. The deduction is equal to 50 percent of the amounts paid per dependent, limited to $5,000. The amounts that can be deducted include amounts paid for uniforms, textbooks and other supplies required by the school.

II.On the chart below, list the name of each qualifying dependent and the name of the school the student attends. If the student is home-schooled, enter “home-schooled.” Enter an “X” in the box in column 1 if your dependent qualifies for the Elementary and Secondary School Tuition deduction, column 2 for Educational Expenses for Home-Schooled Children deduction, or column 3 for Quality Public Education deduction. If you have more than six qualifying dependents, attach a statement to your return with the required information.

|

|

|

Deduction as described |

Student |

Name of Qualifying Dependent |

Name of School |

above in Section I |

|

|

|

1 |

2 |

3 |

A |

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

III.Using the letters that correspond to each qualifying dependent listed in Section II, list the amount paid per student for each qualifying expense. For students attending a qualifying school, the expense must be for an item required by the school. Refer to the information in Section I to determine which expenses qualify for the deduction. Retain copies of canceled checks, receipts and other documentation in order to support the amount of qualifying expenses. If you checked column 1 in Section II, skip the 50% calculation below; however, the deduction is still limited to $5,000.

Qualifying Expense |

|

List the amount paid for each student as listed in Section II. |

|

|

|

|

|

|

|

|

|

|

A |

B |

C |

|

D |

|

|

E |

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tuition and Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

School Uniforms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textbooks or Other Instructional Materials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (add amounts in each column) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If column 2 or 3 in Section II was checked, |

50% |

50% |

50% |

|

50% |

|

50% |

|

50% |

multiply by: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deduction per Student – Enter the result |

|

|

|

|

|

|

|

|

|

|

or $5,000, whichever is less. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IV. Total the Deduction per Student in Section III, based on the deduction for which the students qualified |

as marked in |

boxes 1, |

2, or 3 in Section II. |

|

|

|

|

|

Enter the Elementary and Secondary School Tuition Deduction here and on IT-540, Schedule E, code 17E. |

|

$ |

|

|

|

|

|

|

|

Enter the Educational Expenses for Home-Schooled Children Deduction here and on IT-540, Schedule E, code 18E. |

|

$ |

|

|

|

|

|

|

|

Enter the Educational Expenses for a Quality Public Education Deduction here and on IT-540, Schedule E, code 19E. |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

WEB 62308

ATTACH TO RETURN IF COMPLETED.

Enter your Social Security Number.

SCHEDULE F – 2022 REFUNDABLE PRIORITY 2 CREDITS

Enter credit description and associated code, along with the dollar amount of credit claimed. See the instructions.

Credit Description

1

2

3

4

5

5A |

School Readiness Child Care Directors and Staff Credit - Facility License Number |

Credit Code |

|

Amount of Credit Claimed |

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transferable, Refundable Priority 2 Credits

Enter the State Certification Number from Form R-6135, along with the dollar amount of credit claimed. See the instructions.

Credit Description

6.Musical and Theatrical Production

6A.

7.Musical and Theatrical Production

Credit Code |

Amount of Credit Claimed |

|

|

|

|

|

|

|

6 |

2 |

F |

|

6 |

|

|

|

|

|

|

8. Musical and Theatrical Production

8A.

9.OTHER REFUNDABLE PRIORITY 2 CREDITS – Add Lines 1 through 8. Also, enter this amount on Form IT-540, Line 16.

Description |

Code |

|

Description |

Code |

|

Description |

Code |

|

Description |

Code |

|

|

|

|

|

|

|

|

|

|

|

Ad Valorem Offshore Vessels |

52F |

|

Technology Commercialization |

59F |

|

School Readiness Business – |

67F |

|

Stillborn Child |

76F |

|

|

Supported Child Care |

|

|

|

|

|

|

|

|

|

|

|

Telephone Company Property |

54F |

|

Historic Residential |

60F |

|

School Readiness Fees and Grants to |

68F |

|

Funeral and Burial Expense for a |

77F |

|

|

Resource and Referral Agencies |

|

Pregnancy-related Death |

|

|

|

|

|

|

|

|

|

Prison Industry Enhancement |

55F |

|

School Readiness Child Care |

65F |

|

Retention and Modernization |

70F |

|

Other Refundable Credit |

80F |

|

Provider |

|

|

|

|

|

|

|

|

|

|

|

|

Milk Producers |

58F |

|

School Readiness Child Care |

66F |

|

Digital Interactive Media & Software |

73F |

|

|

|

|

Directors and Staff |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEB 62337